|

DEBT can be a double-edged sword. It's useful for taking advantage of opportunities quickly and it can smoothen things out when people are in a pinch.

Do that too often and eventually the borrowed money will end up being more a liability than a benefit. There is no difference between how the effects of too much debt can affect countries or individuals. Debt is like a rubber band. Stretched too far and it will snap, and that is just what's happening in Europe and recently with the United States when the government reached the ends of its debt elasticity.

For people and households, there too is a prudent limit as to just how much loans one can stomach on their incomes and given that Malaysia has one of the highest debt levels in the region, the rubber band is indeed looking pretty taut.

Over the last one to two years, the increase in Malaysia's household debt has been largely fuelled by the availability of cheap mortgage rates arising from the cut-throat competition in the housing loan market.

Cheap money has enticed people to borrow and the rate of which households are taking on debt to buy houses, cars or finance renovations or holidays has indeed grown.

Since the 2008 global financial crisis, Malaysia's household debt service ratio, which measures the ratio of debt payments to disposable personal income, has jumped about 10 percentage points to 49% in 2009 before easing slightly to 47.8% last year.

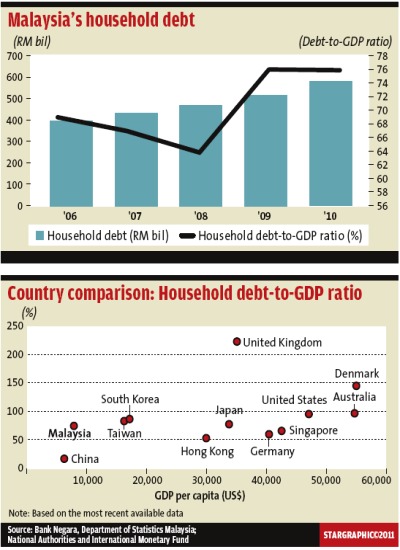

Malaysia's household debt in total rose 12.5% to RM581.3bil last year while debt-to-gross domestic product (GDP) ratio, which measures a country's federal debt in relation to its GDP or the size of its economy, stood at 76% last year, unchanged from the year earlier.

In a broader sense, a growing population where more Malaysians are entering the workforce each year, steady economic growth and rising income levels coupled with a low-interest rate regime have helped provide the impetus for more borrowing by consumers.

Based on data provided by RAM Holdings Bhd, housing loans now account for about half of the total loans in the household sector; they grew by 12.8% in the first seven months of this year, slightly lower than the 13.2% increase recorded last year.

The second largest segment where households have borrowed money for is the passenger car segment and that makes up 24.4% of total household loans. This recorded an increase of 5.8% in the first seven months, but was slightly slower than the 7.7% recorded last year.

Although the smallest segment of total household borrowings, loans for the purchase of shares and for personal use jumped the most and for the first seven months of this year, that segment rose by 18.4% and 16.5% respectively.

Given where household debt as a percentage of GDP is and the earning power of families, concerns are mounting that the country's growing household borrowing activities could possibly make the local financial sector and economy more vulnerable to external economic risks, especially now with the ongoing debt crisis in the eurozone and the lacklustre growth trend in the United States.

Although borrowing in the main segments of housing and passenger cars has slowed down marginally so far this year compared to last year, the absolute amount of borrowing is still rising.

“It will definitely be prudent to slow down consumer and retail lending to keep overall household debt at a prudent level at this stage,” says Dr Yeah Kim Leng, group chief economist at RAM.

Given that 84% of current household debt emanates from the banking system and that lending to households remain strong, growing at 12.8% in the first seven months of this year, it would be prudent to slow down lending, he says

The remaining RM92bil or 16% of total household debt not owing to the banking system can be attributed to loans from employers, money lenders and cooperatives.

The bulk of cooperatives lending to members are accounted for by civil servants and, given the job security in the public sector, the credit risk for cooperatives would remain manageable, says Yeah.

Besides various prudent measures to manage bank borrowing, such as tightening of the lending criteria and capping of banks' exposure to specific household loan types, demand-side initiatives such as consumer education on proper household budgeting and prudent financial planning also needs to be stepped up.

Bank Negara last year lowered the amount people could borrow for the purchase of their third or subsequent house, capping the margin of financing to 70% from 90% previously in a move analysts believe would also curb speculation in the property market.

Yeah believes the situation remains “manageable” for now as Malaysia enjoys full employment status with an unemployment rate of 3.2% last year compared with 3.5% in 2009.

“As long as this (full employment status) is maintained and people are able to service their loans, it should be alright, provided that they have borrowed within their means,” he says.

A banking analyst with ECM Libra Research points out that the balance sheets of local banks are “still very strong,” helped by their conservative nature, and that loan default rates are low. As at July, the net impaired loan ratio stood at 2%.

The highest mortgage non-performing loan ratio has ever been was at 8.6%, or about RM14bil, in 2006. Since 2007, the figure has been declining steadily, giving confidence to the fact that household debt appears to be contained.

Another banking analyst points out that although household debt level in Malaysia is high, locals have a relatively high savings rate, at about 35% of GDP.

Still, RAM's Yeah cautions against any further increase in household debt levels and the debt servicing ratio, as this will increase the financial risk and vulnerability not only for consumers but also for the lenders and, ultimately, the overall economy.

“It is, therefore, prudent to pare down the debt level now and make the economy and society more resilient to future domestic and external shocks,” he says.

CIMB Research head of economics Lee Heng Guie concurs, saying that excessive household indebtedness not only raises concerns over its sustainability but also poses a risk to the overall financial system.

“High levels of household debt may also constrain the effectiveness of monetary policy as it increases the sensitivity of the behaviour of households to changes in interest rates,” Lee points out.

Prime Minister Datuk Seri Najib Tun Razak said while banks' portfolio for lending to the household sector had increased, it was important that the household sector did not become excessively leveraged.

“We have seen the consequences of such developments in other parts of the world. In this regard, financial institutions should exercise prudence and employ responsible lending practices to ensure a sustainable household sector, which will in turn, support sustainable growth, given the major role of consumption in the economy,” Najib said at the recent opening of Bank Negara's Sasana Kijang building.

“We want to have more financially savvy consumers who are not only able to make the right decisions with respect to their finances, but also are not vulnerable to scams and driven to the informal sector,” he said. |