PETALING JAYA: Amid a weak overall market sentiment and a recent warning on its profitability and dividend payment, Tenaga Nasional Bhd's (TNB) share price fell to its lowest in 28 months.

The company's shares closed at RM5.49 yesterday down 6 sen from their previous close.

Some analysts believed that the counter would remain under selling pressure, especially under the current market condition.

TNB president CEO Datuk Seri Che Khalib Mohamad Noh had said last Thursday that the company might not be able to maintain its dividend payments for the current financial year ending Aug 31 (FY11) as the gas curtailment exercise by Petroliam Nasional Bhd (Petronas) had severely impacted its bottom line.

TNB's dividend policy is to pay out 60% of free cash flow. But high fuel costs, resulting from the company having to resort to generating electricity through other sources such as coal, oil and distillate, had put a strain on its free cash flow.

“The higher use of distillate will hurt TNB's earnings, as the company's electricity tariffs do not have a pass-through for the fuel, which cost six times more than gas. Also, the protracted use of distillates is not advisable for gas plants, as they are not designed to run on the substitute fuel,” CIMB Research noted in its recent report.

ECM Libra analyst Foong Wai Mun concurred: “As long as the gas supply issue is not resolved, TNB's earnings will remain under pressure.”

Nevertheless, there were 12 “buy” calls on TNB's counter according to Bloomberg's poll of 24 analysts. Seven analysts had a “neutral” stance on the company's shares, while five recommended a “sell”.

Gas supply to TNB would likely normalise by the middle of next year when Petronas' re-gasification terminal for liquefied natural gas in Malacca becomes ready.

Che Khalib had emphasised the need for more efficient power plants that could generate more electricity from the same or less amount of gas. He said the building of new gas-fired plants would be necessary.

TNB's stand was for the first-generation power purchasing agreements (PPAs), expiring in stages from mid-2015 to 2016, to lapse.

The industry, it argued, should move towards an open tender process that would allow the most competitive player to supply new capacity.

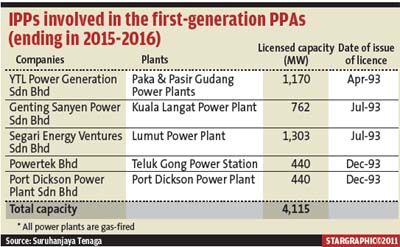

Renegotiations with independent power producers (IPPs) involved in the first-generation PPAs had taken place for quite some time now but had remained inconclusive.

The IPPs are YTL Power Generation Sdn Bhd (a subsidiary of YTL Power International Bhd);Genting Sanyen Power Sdn Bhd (a subsidiary of Genting Bhd); Energy Ventures Sdn Bhd and Port Dickson Power Plant Sdn Bhd (subsidiaries of Malakoff Bhd); and Powertek Bhd. Collectively, they come with a generating capacity of 4,100 megawatts through coal-fired power plants.

TNB was expected to announce its decision on whether to renew the first-generation PPAs within a year or so to give sufficient time for new or existing players to prepare to bid and build new power plant capacity. “If the move towards competitive bidding process becomes a reality, the existing IPPs could prove to be less competent than new bidders, simply because technology has changed, and the efficiency levels of power plants have also changed over the years,” Foong said.

While analysts reckoned that a non-renewal of first-generation PPAs could be a setback for the IPPs in terms of stable income lost, they believed the initiative would not severely impact the IPPs' bottom line.

An MIDF analyst said it won't be a “win or lose” game.

“Existing IPPs could still put in their bids, only that they would have to offer more attractive pricing to TNB,” she said.

“And even if their PPAs were not renewed, those IPPs could cushion any potential setback to revenue, as they already have a diversified business model, including operations overseas that could generate better revenue,” she added.

|