|

FRESH off its historic merger with Kencana Petroleum Bhd, SapuraCrest Petroleum Bhd again made the news with its agreement to acquire Clough Ltd's marine construction and offshore engineering operations in Australia for A$127mil (RM400mil).

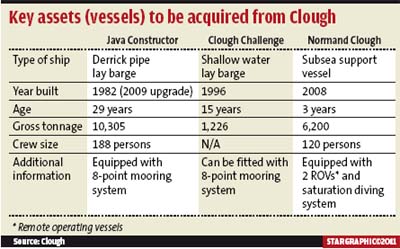

The acquisition took no one by surprise, coming as it did on the heels of an announcement in July that it was in talks with Clough. The key assets acquired include a derrick pipelay barge (Java Constructor), a shallow water lay barge (Clough Constructor), and a subsea support vessel (Normand Clough) as well as two deepwater remote operated vessels. The acquisition is expected to be completed in the fourth quarter of 2011.

Clough, it would seem, was eager to sell off that part of its business, which has been loss-making.

For the six months ended Dec 31, 2010, Clough's marine construction segment turned in a loss of A$7.6mil (RM24.3mil) on the back of A$28mil (RM89.6mil) revenue. Clough attributed the poor performance to the lack of work orders during that period. One of their vessels, in fact, had to be left idle at the time.

But this is no toxic asset. The consensus from analysts is that it will play a role in expanding SapuraCrest's fleet capacity and enable it to venture into the subsea construction, umbilicals, risers and flowlines (SURF) business that it is not currently a part of.

An AmResearch report noted: “The acquisition represents SapuraCrest's strategy of expanding its subsea and deepwater capabilities to include conceptual front-end engineering design, detailed design of platforms and pipelines as well as SURF services. Given the group's current foothold in offering offshore construction services in Australia, the acquisition allows further penetration into Indonesia, Vietnam, Thailand and Brazil.”

ECM Libra was also upbeat about the deal, saying in a report that it was timely as SapuraCrest's existing fleet capacity is almost fully utilised.

“New assets will allow the group to handle other major oncoming contracts like the Malikai-Kebabangan pipe-lay job. Recall that they last week landed a RM1.3bil job for the financial year 2014 (FY14) that will fully engage their Sapura3000 vessel,” ECM Libra said. It added that since Kencana did not have a SURF business, the acquisition would be positive for the merged entity as well.

To recap, Kencana and SapuraCrest are heading for a merger that will create Malaysia's largest oil and gas (O&G) service provider by asset size at RM6bil and second largest by market capitalisation at RM10.88bil.

SapuraCrest is headed by executive vice chairman Datuk Shahril Shamsuddin and Kencana by CEO Datuk Mokhzani Mahathir, both of whom share a three-decades-long friendship.

The board of directors of both companies have consented to the merger valued at RM11.85bil, which will see special purpose vehicle Integral Key Sdn Bhd (IKSB) buy up the assets, liabilities and business undertakings of both Kencana and SapuraCrest, to be paid in cash and new shares in IKSB. The merged entity is expected to carry the torch of the local O&G industry, starting with fulfilling six O&G-related entry point projects under the Government's Economic Transformation Programme.

Thus far, the Clough deal and a recent acquisition of a 50% stake in Labuan Shipyard and Engineering Sdn Bhd for RM25mil cash make up only 16% of SapuraCrest's capital expenditure target. Shahril had said the group plans to spend up to US$900mil (RM2.7bil) within the next two years to build more capacity and grow in the region. This latest acquisition appears to be a good deal for SapuraCrest.

AmReseach said: “Based on Clough's historical FY10 results, the acquisition price earnings translates to an attractive five times while Clough is only expected to generate a one-off gain of A$8mil (RM25.2mil) from the sale”. The caveat, it added, was that the acquisition would add value to SapuraCrest only if it helped accelerate the group's order book accretion. Analysts expect SapuraCrest to reap the benefits from FY13 or FY14 onwards.

But what does this acquisition mean for the merger? In terms of SapuraCrest's asset size, an analyst said it did not factor much since the company bought the assets in cash. “Furthermore, there is a merger committee, so both sides should be aware of this development,” he said.

However, there will be a slight impact on the merged entity's borrowing levels, based on its current estimated net gearing of 0.3 times.

“If the group continues in its aggressive expansion plans, we expect the merged entity's net gearing level to reach 0.6 times, but still lower than Bumi Armada's 0.8 times currently,” AmResearch said.

Meanwhile, the merger has issues of its own to be ironed out, like which leader - Shahril or Mokhzani - will take the helm of the eventual merged company. Whatever the outcome, the Clough deal bodes well for SapuraCrest and gives it the leverage to expand regionally.

As it stands, the two vessels that will be acquired Java Constructor and Clough Challenge - are being used to install pipelines for the Gorgon project, which is a joint-venture between Clough and Chevron Australia for a A$300mil domestic gas (DOMGAS) contract.

In turn, the DOMGAS contract may be taken over by SapuraCrest, a move ECM Libra described as a “good start for the group to turn the business to the black”.

|