|

PETALING JAYA: More clarification is needed on the off-takers or customers of a proposed RM17bil integrated petro-chemical complex in Teluk Ramunia, Johor, according to research analysts.

Analysts contacted by StarBiz yesterday said there were concerns over the project financing needed.

“The question is can KNM Group Bhd, Zecon Bhd and Gulf Asian Petroleum Sdn Bhd (GAP) get the required financing for the project? In a project of this size, financial institutions and lenders will need details on confirmed off-takers or customers and also the return on investments,” said an analyst.

KNM and Zecon had on Monday said in Bursa Malaysia filings that preliminary deals had been signed with GAP to build the integrated petro-chemical complex.

KNM said the engineering, procurement, construction and commissioning contracts were for a 150,000/200,000 barrels per day petroleum refinery and 400,000/525,000 million tonnes per annum polypropylene unit and also, a petroleum storage terminal facility.

Under the deal, KNM and Zecon together with an international Korean or Chinese contractor will form a consortium to undertake the petroleum refinery and polypropylene unit projects.

The consortium will take up to 20% equity in GAP, which is estimated at US$180mil (RM540mil).

The petroleum refinery and polypropylene unit projects will be funded by 30% equity and the balance through project financing using export credit agencies or other financial instruments including sukuk issuance.

As for the petroleum product storage terminal facility project, GAP will arrange for a financial guarantee from a local investment fund for up to RM1.5bil during the construction period, to be converted into a long-term loan thereafter, and a facilitation fund of up to RM300mil, while KNM will arrange a sukuk issuance of up to RM1.5bil to cover project financing during construction.

KNM said that concerning the petroleum product storage terminal facility, GAP had entered into preliminary deals with international suppliers of crude oil and petroleum products, which are subject to financial close for the supply and off-take agreements.

Meanwhile, in a recent note, ECM Libra Investment Research upgraded the stock of KNM to a “Trading Buy” from “Hold”, with a target price of RM2.25.

However, the ECM Libra note said at this juncture, KNM might have too much on its plate and, as such, there were concerns over its project execution capabilities and margins.

“Its order book amounts to RM5.4bil and projects in Uzbekistan and the United Kingdom have only just taken off. Also, we estimate that the group has some RM1bil of older orders to clear off that was accumulated over the previous financial year.”

HwangDBS Vickers Research noted that this would be the single largest contract ever for KNM, boosting its order backlog to RM14bil.

The HwangDBS Vickers Research note maintained a buy call for KNM's stock at RM1.75 and a 12-month price target of RM3.35.

An OSK Research note said that due to past events, there were doubts on whether the project would take off.

“In March 2008, Qatar-based Gulf Petroleum Ltd's plans to construct a US$5bil oil and gas complex in Malaysia petered out even though it had earlier signed an agreement with the Malaysian Government. Other than that, we believe that securing the project financing itself has some uncertainty given the huge sum needed,” said OSK Research, which maintained its buy call on KNM's stock at RM1.75, and a fair value of RM2.80.

The share prices of KNM and Zecon have jumped since the announcement of the deal on Monday, and were among the most actively traded on Bursa Malaysia yesterday.

In the past two days, KNM's share price rose from RM1.75 to close at RM1.99 yesterday.

Zecon's share price jumped by 85% over two days to close at 89 sen yesterday.

Zecon's warrants rose by 300% over two days to close at 56 sen yesterday.

Meanwhile, oil and gas industry professionals say there should not be a situation of overcapacity in the oil refinery industry when new refineries come online in the next few years.

A senior manager in the oil and gas industry said there was a need for Malaysia to build more refineries.

“There is no question of overcapacity now, as some players with petrol retail and service stations are buying from Singapore. About 30%-40% of fuel sold across the country comes from Singapore,” said the senior manager.

Presently, Malaysia has five refineries with a total capacity of 560,000 barrels per day.

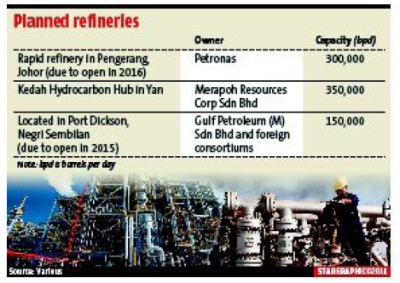

Petroliam Nasional Bhd (Petronas) is investing in a RM60bil integrated refinery and petrochemical complex in Pengerang, Johor, which is expected to be commissioned by the end of 2016.

Known as the Refinery and Petrochemicals Integrated Development (Rapid) project, it will comprise a crude oil refinery with a 300,000 barrels per day capacity, a naphtha cracker that will produce about three million tonnes of ethylene, propylene, C4 and C5 olefins per year, and a petrochemicals and polymer complex.

Earlier this month, it was reported in a local daily that Kedah Mentri Besar Datuk Seri Azizan Abdul Razak stated the proposed RM83bil Kedah Hydrocarbon Hub project in Sungai Limau, Yan would be carried out as planned.

Two years ago, Merapoh Resources Corp Sdn Bhd had announced that the US$10bil (RM30bil) oil refinery in Yan would be the biggest in the country, with a production capacity of 350,000 barrels per day, and was due to be completed by 2013 or early 2014.

Also, Gulf Petroleum (M) Sdn Bhd (GPLM) and several foreign consortiums agreed in May this year to jointly develop a RM17bil integrated petro-chemical complex in Port Dickson, Negri Sembilan which would have a production capacity of 150,000 barrels per day when it is completed in 2015.

|