|

PETALING JAYA: Malaysian banking giants CIMB Group Holdings Bhd and Malayan Banking Bhd (Maybank) saw a whopping RM2.5bil wiped out of their market capitalisation since reports surfaced that the Indonesian central bank was looking at limiting single party ownership of banks there. Both CIMB and Maybank have significant exposure in those markets, with the former's subsidiaries contributing a significant amount of profits to the group.

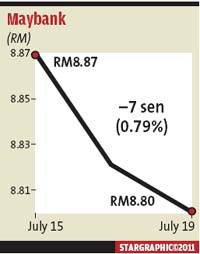

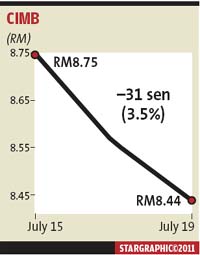

CIMB's stock had shed 31 sen since last Friday, to close at RM8.44 yesterday, wiping out more than RM2bil of its market capitalisation in the process. Maybank, meanwhile, saw its shares dip by a total of 7 sen since last Friday, losing about RM500mil in its market capitalisation.

Analysts, however, said that the concerns might be “overblown,” for now at least.

“We think it is too preliminary to take action on the stocks,” Hwang DBS Vickers Research told clients yesterday while OSK Research said the Indonesian central bank's plan to study limits on single-party ownership in banks was currently “unsubstantiated.”

On Monday, Indonesian news reports said Bank Indonesia was studying plans to limit single-party ownership in commercial banks to not more than 50% but that this was still at the assessment stage.

No level of ownership or time frame for this to happen had been set although there was a possibility that the regulation could be issued this year, with a “lengthy” transition period, a Reuters report noted quoting Bank Indonesia governor Darmin Nasution.

If the regulations are passed, it would be more negative for CIMB than for Maybank, analysts said.

CIMB, with its 97% stake in PT Bank CIMB Niaga Tbk, derives 35% of its earnings from its Indonesian operations and, assuming its stake is halved, earnings could decline by 10%-13% over the next couple of financial years, based on Hwang DBS' calculations.

That said, should CIMB be able to sell down its stake in CIMB Niaga, it would be able to reap capital gains which could more than offset the earnings decline but this would be one-off and subsequent earnings excitement would have to largely depend on its Malaysian operations, Hwang DBS said.

According to OSK Research, CIMB is likely to raise proceeds of RM7bil to RM8.4bil from its stake sale.

In the case of Maybank, Bank Internasional Indonesia contributed less than 5% to the group's earnings so if Maybank had to sell down its stake, the impact to earnings would be minimal, Hwang DBS said.

ECM Libra in its Monday report to clients said it had not made any adjustments to the potential earnings of the banks, in view of the uncertainties and complexity of the entire issue.

“Although we do acknowledge that the potential implementation of the new regulation retroactively could pose a downside risk to CIMB and Maybank's earnings potential,” it said.

|