|

WHILE many agree that the merger between SapuraCrest Petroleum Bhd and Kencana Petroleum Bhd will open the door for the combined entity to land more lucrative and bigger contracts, the giant in-the-making will still need to gain more experience before it can independently bid for the development of oil and gas (O&G) fields.

OSK Research's Jason Yap says the merged entity will continue to be an O&G supporting services player before it can independently develop marginal oil fields.

“Maybe after the Berantai experience where it will learn from Petrofac via technology transfer on oil extraction processes it can bid for marginal oil fields on its own. This is because O&G extraction is a different kind of expertise.

“Ultimately, the new entity is expected to go deeper into the upstream development but not too soon,” he says.

But Yap does not rule out the entry of a new partner in the new entity to inject O&G extraction expertise and fast-track the company's effort to build its capabilities to bid independently for the development of marginal O&G fields.

SapuraCrest already has Seadrill Ltd, a leading offshore deepwater drilling company, as one of its major shareholders with 23.59% stake in the company.

An ECM Libra Investment Research analyst expects the new entity will have the capability for whole turn-key contracts for shallow and conventional wells soon after the merger.

“The new entity will be able to offer a complete package of fabrication and installation services. We are looking at bigger and more lucrative contracts.

“Going forward, I think they inevitably will have to climb the value chain towards deepwater development,” she said.

A source close to the merger deal reveals that the main driver for the two companies' marriage is to be able to compete with other international players for upscale category of contracts.

“They are not just eyeing local jobs but they want to go international.

“Both companies have learnt from their joint ventures (JVs) with foreign partners. If the job description entails exploration to hook-up and commissioning', the new entity could bid on its own now,” he said.

The investment bankers for the deal, Maybank and CIMB, expressed their confidence at a media briefing earlier this week that the merged entity would have full capabilities to undertake exploitation of marginal fields and enhanced oil recovery activities.

They say the merged entity will complete the EPCIC (engineering, procurement, construction, installation and commissioning) value chain from exploration, drilling, engineering and design, fabrication, offshore installation, hook-up and commissioning as well as offshore support vessels.

“Technically, the merged entity can go alone to bid for the upcoming Petronas marginal oil contracts,” says the source.

In January, Petronas awarded the first marginal field contract via a risk-service contract method to a consortium that consists of Kencana, SapuraCrest and Petrofac Energy Developments Sdn Bhd (PED) to develop and produce petroleum resources in Berantai over a nine-year period starting from Jan 31 this year.

The joint operating venture will be 50% owned and led by PED, part of the London-listed Petrofac Ltd group of companies, while Kencana and SapuraCrest would each hold a 25% interest.

The foreign player, in the consortium will act as the main contractor to develop and operate the marginal oil fields. Together, the consortium will provide end-to-end solutions.

Since then, the national oil company has not awarded any other marginal field contracts yet but market talks speculate of another one soon.

Two marginal fields offshore Sarawak, believed to be Balai and Bentara, are the next marginal fields to be awarded.

Malaysia has 106 marginal oil fields containing 580 million barrels of oil, with Petronas having firm plans to develop 25% of the total marginal oil fields to replenish its oil reserves and generate new revenue.

A marginal oil field is defined as a field that can produce 30 million barrels of oil equivalent or less.

Besides the marginal oil field contracts, the ECM Libra analyst says that for a start the new entity could be eyeing some jobs regionally, such as in Vietnam and Thailand, that involve pipe-type oil field development.

“The new entity may also be eyeing Tapis-enhanced oil recovery projects,” she said.

SapuraCrest executive vice-chairman Datuk Shahril Shamsuddin was previously quoted as saying: “We need to learn to complete our value chain now. What happens to the local oil and gas industry when all the oil here runs out? So we'll have to start developing our capabilities now to get the jobs out there in future.”

This merger, if it materialises within the stipulated timeframe of between six and eight months, will coincide with the positive outlook for the O&G industry.

Earlier this year, Petronas announced that it would be spending RM300bil in capital expenditure over the next five years.

OSK Research, which attended the 16th Asia Oil and Gas Conference in June, gathers that almost all the speakers at the conference were positive on the industry outlook going forward.

“Although most of the producing fields in Malaysia are mature fields, there is still ample potential in the deepwater and higher reservoir areas.

“Also, there are marginal oilfields and enhanced oil recovery projects that can contribute to overall total production and with Petronas actively participating in these areas, Malaysia could potentially become an O&G hub, at least for the South-East Asia region,” says OSK. It adds that oil price is likely to stay around US$100 per barrel this year because of supply fears due to unrest in the Middle East and the fact that oil is still being used as a hedging instrument against the weakening greenback.

Deepwater and marginal field exploration can be sustained if oil prices are between US$70 (RM210) and US$80 (RM240) a barrel.

On competition, the analyst says the new entity will be the only one in Malaysia with the capability to cover the whole value chain of pipe-type oil field developments.

“If they are heading towards deepwater structures and installation, then the direct competition should be Malaysia Marine and Heavy Engineering Bhd (MMHE),” she said.

In terms of domestic ranking, the merged entity will be second in terms of market capitalisation at RM10.8bil, marginally below that of MMHE, but in terms of asset value, it will be on top of the list at RM6bil.

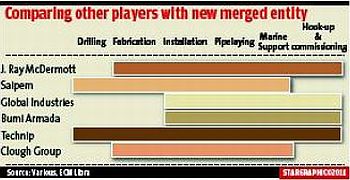

In the international arena, Maybank and CIMB say the merged entity will be fourth in ranking both in terms of market capitalisation and asset value, below three other giants namely Saipem, Technip and McDermott.

There are many foreign oil companies which focus largely on marginal oilfields. They include London-based Petrofac, US-based Newfield Exploration Co, UK-based Salamander Energy Plc, Abu Dhabi's Mubadala Oil & Gas, Australia's Roc Oil Co Ltd, French-founded Perenco Group and Swedish Lundin Petroleum AB.

|