|

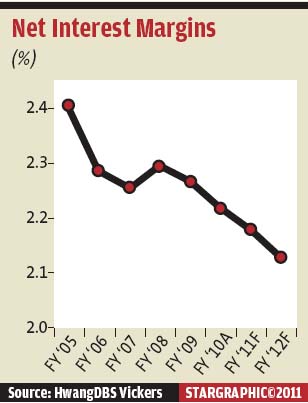

PETALING JAYA: Net interest margins (NIMs) of banks are expected to remain compressed due to intense competition among banks for mortgage loans and deposits amid anticipation of further interest rate hikes this year, analysts said.

ECM Libra Investment Research said the intensified competition had restricted the ability of banks to expand their NIM despite being in an interest rate upcycle environment.

“We understand that competition in the banking sector is not only in the mortgage market but also in attracting current account and savings account (Casa) deposits, which will dampen prospects of margin recovery in the near term,'' it added.

The research outfit said it remained cautious on the interest margin outlook of domestic banks this year notwithstanding a 25-basis point overnight policy rate (OPR) hike recently as well as another 25-basis point hike expected in the second half of the year.

Bank Negara headquarters in Kuala Lumpur Bank Negara headquarters in Kuala Lumpur

Bank Negara on May 5 had raised the OPR by 25 basis points to 3% and many analysts are expecting at least another increase of 25 basis points in the second half.

NIM is a measure of the difference between the interest income generated by banks and the amount of interest paid out to depositors.

HwangDBS Vickers senior banking analyst Lim Sue Lin told StarBiz her forecast for NIM for the year was at 2.18%, adding that she expected NIM to remain compressed despite the likelihood of another OPR hike.

Lim believed competitive pressure in the banking sector would be intense as banks would consider offering lower lending rates. Deposit rates may be higher depending on the banks as they could also participate in deposit campaigns, she said.

RAM Ratings head of financial institution ratings Promod Dass said banks with a predominantly floating rate loan book and with a large proportion of Casa would benefit the most, but over the long term, NIMs for Malaysian banks would see further compression as competition for mortgage loans (which typically refer to the base lending rate) would still be intense.

“NIMs for Malaysian banks now typically hover between 2% and 3%, which is higher than the 1.5%-2% generally observed in Singapore and 0.7%-1% seen in Japan. Compared to the over 5% NIMs generally earned by banks in Indonesia and 3%-4% garnered by Thai banks, NIMs achieved by Malaysian banks are considered lean.

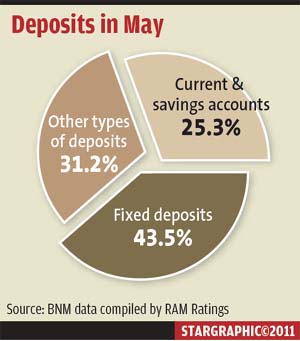

“We have seen competition for deposits in Malaysia heightened and the game plan for most banks is to build up Casa deposits. Casa deposits account for about a quarter of the Malaysian system's deposits. Total deposits grew by about 8% year-on-year between December 2009 and 2010. The momentum is expected to continue in 2011,'' Dass said

Anandakumar Jegarasasingam Anandakumar Jegarasasingam

Malaysian Rating Corp Bhd vice-president and head of financial institution ratings Anandakumar Jegarasasingam(pic) said he expected NIM to be tightened considering the more intense competition among banks and gradual increase in lending to rate-sensitive corporate borrowers.

Lending to corporate borrowers was progressively increased, especially on the back of the Economic Transformation Programme projects, he said, adding that corporate borrowers were more sensitive to interest rates than households.

Competition for deposits would remain strong among banks, especially for low-cost deposits as banks try to augment their low-cost deposit base to fight off margin pressure, Anandakumar said. |