THINK twice before buying shares of a company that will not include the issuance of new shares but the sale of existing shares by its original shareholder(s) during the company's initial public offering (IPO) exercise.

A common piece of advice parted to investors when fishing for new stock investments is if a company that is to be listed offers a great growth story, why would the original shareholder(s) look to reduce his stake significantly? No doubt the original shareholder(s) will want to make a profit during the IPO exercise, but why not have a combination of an offer for sale and issuance of fresh shares to continue enjoying the potential upside the stock will have once listed?

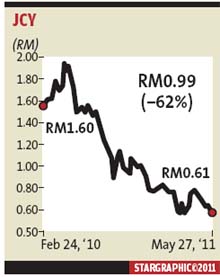

One company that comes to mind is Malaysian hard disk-drive component maker JCY International Bhd, which was listed on the Main Market over a year ago. The company promised a good growth story and was touted at one point during its fund raising exercise as potentially being South-East Asia's largest technology IPO exercise since 2000.

Based on previous news report, YKY Investment Ltd, controlled by Malaysian businessman Y.K. Yong, had originally wanted to sell some 530.2 million existing shares, or 25.9%, of the company to institutional and non-institutional investors at RM1.60 to RM2.20 per share.

Several analysts had then said that the company's indicative IPO price of RM2 per share for retail investors was fairly valued and offered minimum upside. ECM Libra Investment said in a report then that the IPO was priced at a historical earnings multiple of 19.7 times while a smaller peer like Notion VTec Bhd traded at a historical multiple of 11.8 times, making JCY very expensive.

Shortly after, the company slashed its offer size for institutional investors (some reports attributed this to weak demand) and finally sold a total of 443 million existing shares at RM1.60 to institutional investors and RM1.52 to retail buyers. Some analysts had said that the RM1.60 price tag valued the company at nine times 2010 estimated earnings.

Since listing in late February 2010, the company has seen its share price take a beating, losing 62% of its listing price value and ending at 61 sen as at last Friday. The lacklustre appeal in the stock has been mainly due to declining profits although analysts had said then that the company was likely to do well on the back of the technology industry having a bright future.

Many of the “buy” calls recommended by research houses covering the stock have been switched as of late last year to a “sell” or “hold” due to the company's poor earnings. From the six quarterly results announced by the company after its listing in February last year, two quarters reported growth in revenue and earnings, one quarter saw revenue and net profit somewhat plateau while the last three quarters recorded a decline in revenue and earnings.

For the fourth quarter ended Sept 30, 2010, the company posted a net loss of RM22.6mil against a net profit of RM73.5mil a year ago while revenue slipped to RM486mil from RM501.2mil a year ago.

For the first quarter ended Dec 31, 2010, the company made a net profit of RM7.5mil against RM77.5mil a year ago while revenue was down to RM438.9mil from RM528.2mil posted for Dec 31 2009.

More recently, the company announced middle of this month that its second quarter ended March 31 saw net profit slide 81% to RM12.5mil on the back of lower revenue by 28% at RM397.4mil from a year ago.

The reason for lower second quarter revenue was due to the depreciating US dollar against the ringgit and lower volume of components sold for the current quarter as a result of weakening global demand for HDDs. It added that lower pre-tax profits was due to higher cost of production as cost of raw materials such as aluminium and stainless steel as well as labour cost have gone up.

On its outlook for the remaining year, the company has cautioned that a stronger ringgit and shortage of local labour coupled with higher raw material prices will continue to affect the profitability of the HDD component manufacturers. Also, a shortage of HDD components due to the natural disaster in Japan could affect its output.

This paints a bleak outlook for the company, as seen with OSK Research revising its forecast for the company.

“Taking an increasingly conservative stance as a result of the poor showing in the first half of financial year ending Sept 30, 2011 (FY11), we cut our FY11 topline estimate by 9.1% to RM1.9bil. Correspondingly, our FY11 earnings per share dropped by 29.4% to 4.6 sen,” it said in a report this month.

Due to the earnings downgrade and having pegged the stock at a nine times FY11 PER, OSK Research said the company's fair value for its share price was 41 sen, not too far away from its current net tangible asset per share of 43 sen.

“At nine times FY11 PER, it will be trading close to the 10x historical peak PER valuation of Notion and Engtek (Eng Teknologi Holdings Bhd) over the last 5 years and 11 years respectively. We believe the slight discount to its peers is more than justified given JCY's earnings volatility,” it said.

Based on Bloomberg data, three out of the seven analysts covering the stock have recommended a “sell” or “underperform” on the stock with the target price ranging between 41 sen and 64 sen.

The question that begs asking now is what happens to the investors who bought into the company's growth story one year ago and paid either RM1.60 (institutional) or RM1.52 (retail), only to sit on hefty paper losses a year later? Do they cash out at a loss now or wait on the hope that the company will see better days down the line?

A key take-away from all this is that the next time a new company is to be listed, equal importance should be given to the key risks attached to the company's business, especially if its business operates in a highly cyclical sector. |