KUALA LUMPUR: The rally in crude palm oil (CPO) that pushed prices to near RM4,000 a tonne early this year has probably ended. Higher output and inventory, besides weaker demand, will hurt CPO prices, according to analysts.

Supply factors will have an upper hand in dictating prices in the coming months, analysts believe, although global dynamics — including the strengthening of the US dollar — are expected to play a role in commodity prices as well.

“Palm oil has its own fundamentals,” ECM Libra Investment Bank Bhd senior analyst Arhnue Tan told The Edge Financial Daily yesterday.

The analyst, who forecasts that palm oil prices will trade at an average of RM3,000 a tonne for 2011, said another rally in the commodity in the near term was unlikely as she did not foresee demand and supply shocks affecting the dynamics of the industry.

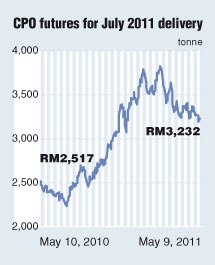

The third month active Malaysian CPO futures contract price declined 18.4% to about RM3,239 a tonne yesterday from a nearly three-year high of RM3,967 on Feb 10, as a seasonal production upcycle towards the second half of 2011 crimped prices.

Local CPO output rose by a monthly pace of 29% to 1.42 million tonnes in March compared with the 3% gain seen in February, according to the Malaysian Palm Oil Board (MPOB).

Total inventory grew 9% to 1.61 million tonnes in March compared with 4% growth in February. Exports saw a 11% rise in March against a 9% contraction in the preceding month. MPOB will release its April figures today.

JF Apex Securities analyst Ng Keat Yung expects palm oil prices to weaken towards the end of this year due to stronger production in 2H11. He foresees that local exports of the commodity will be relatively stable. JF Apex Securities analyst Ng Keat Yung expects palm oil prices to weaken towards the end of this year due to stronger production in 2H11. He foresees that local exports of the commodity will be relatively stable.

Excluding the weather factor, Ng said the latter part of the year has been, in historical terms, a period of better yields.

“Inventory will build up and reduce prices. It is a seasonal factor,” Ng told The Edge Financial Daily yesterday. He forecasts that CPO prices will average between RM3,000 and RM3,100 a tonne this year.

Based on fundamentals, Ng said prices should go down, “unless something unexpected happens”.

The analyst said it was difficult to ascertain the impact of flooding along the Mississippi River in the United States, which is expected to hurt soybean production. The US is the largest soybean producer in the world, accounting for about a third of global output, according to the US Department of Agriculture.

Prices of palm and soybean oil move in tandem by virtue of these commodities being substitutes for each other. Supply constraints and higher demand in the soybean oil market, for example, will raise prices of the crop and at the same time generate demand for palm oil, hence resulting in higher CPO prices.

Early this year, CPO fundamentals were pointing towards RM4,000 a tonne, taking into account declining palm oil production during the seasonal downcycle then. This coincided with adverse weather due to the La Nina phenomenon which caused heavy rains in Indonesia and Malaysia, the world’s major oil palm growers.

Soybean supply constraints due to dry weather in the Americas as a result of La Nina also boosted CPO prices then.

During the previous commodity upcycle in 2008, CPO soared to a record high of about RM4,200 a tonne, driven by a rally in soybean oil as well as crude oil prices, which surged to a record US$147 (RM439.53) per barrel.

The price correlation between CPO and crude oil was relatively high back then due to the hype surrounding the biodiesel industry.

However, an analyst noted that the price correlation is now weak, as the biodiesel industry in Malaysia has failed to take off with the government delaying mandatory blending requirements.

“Only Europe is aggressively pursuing biodiesel policies, and they are using rapeseed oil as the main feedstock,” the analyst said. |