PETALING JAYA: Industry observers believe that a hike in the statutory reserve requirement (SRR) by Bank Negara is likely at the next monetary policy committee (MPC) meeting in March.

The SRR is a monetary policy instrument available to Bank Negara to manage liquidity and credit creation in the banking system. It is used to withdraw or inject liquidity when the excess or lack of liquidity in the banking system is perceived by the central bank to be large and long term in nature.

It is currently at a historical low of 1% from 3% to 4% in 2008.

An economist from a local bank-backed brokerage said a rise in the SRR might be implemented to curb the inflow of hot money.

“Looking at current trends, the central bank will do it. If it feels hot money is coming in and that there is a need to avoid misalignment in asset prices, it will increase the SRR,” he said.

Hot money refers to funds which flow into a country to take advantage of a favourable interest rate, therefore obtaining higher returns.

On Thursday, the central bank maintained the overnight policy rate (OPR) at 2.75% as it considered the existing monetary policy stance as appropriate and consistent with the current assessment of economic growth and inflation prospects.

However, it said that it would consider other policy tools such as the SRR and macro-prudential lending measures to ensure domestic macroeconomic and financial stability.

Affin Investment Bank in its research note yesterday also said the SRR was likely at the next MPC meeting.

“There is a possibility that Bank Negara may raise the SRR, which was cut from 4% in October 2008 to 1% in February 2009, in the next MPC meeting, but keeping its policy rate unchanged,” it said.

Maybank Investment Bank said: “The latest monetary policy statement not only continued to highlight the risk to macroeconomic and financial stability from the volatile international financial market conditions amid increased global liquidity and hence short-term capital flows, but added that policy tools such as the SRR and macro-prudential lending measures may be considered.

“This raises the odds of the SRR rising in the next MPC (on March 11) and we are factoring in (more than) a 100 basis points adjustment.”

According to AmResearch Sdn Bhd senior economist Manokaran Mottain, a 1% hike in SRR can remove at least RM3.9bil from the banking system.

ECM Libra Investment Research, meanwhile, said besides the SRR hike, Bank Negara might also implement macro-prudential lending measures to alleviate the risk of financial imbalances.

“In this context, we believe lending to the household sector will likely be targeted given the very strong growth seen in loans for residential property, non-residential property, personal use and credit card,” it said.

Meanwhile, Bank Negara said in a statement yesterday that net financing to the private sector in December increased by RM17.7bil, or 11.4%, versus RM8.8bil, or 10.8%, in November, driven mainly by higher private debt securities issuances.

Loans outstanding rose moderately by 36.6% during the month.

“The expansion in business loans outstanding in December compared with the previous month reflected mainly the increased investment and working capital needs of firms in the real estate; manufacturing and construction sectors.

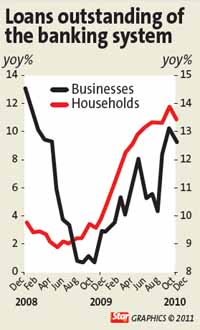

“Meanwhile, the pace of expansion for household loans moderated. Overall loan demand, nevertheless, increased during the month following a slight moderation in November, supported mainly by the business sector,” the central bank said.

Year-on-year, banking system loans outstanding for households and businesses grew 13.4% and 9.4% respectively in December.

Bank Negara said the banking system remained well-capitalised with the risk-weighted capital ratio and core capital ratio at 14.6% and 12.8% respectively. “The level of non-performing loans, including impaired loans, remained stable to account for 2% of net loans. Loan loss coverage remained above 90%.”

Interbank rates were stable in December. In terms of retail rates, the average base lending rate of commercial banks was unchanged at 6.27%. Retail deposit rates were also stable.

Broad money expanded at a more moderate pace of 7% in December. The increase reflected higher government spending to finance its outlays and higher credit extension by the banking system to the private sector.

“These factors, however, were partially mitigated by the drawdown of deposits by the private sector to finance the purchase of Bank Negara securities from the banking system,” it added. |