PLUS Expressways Bhd

(June 23, RM3.38)

Maintain buy at RM3.38 with a target price of RM3.98: Malaysia and Singapore have agreed to reduce their respective toll charges at the Second Link by 30% effective Aug 1, 2010. The consensus was reached after a meeting between Prime Minister Datuk Seri Najib Razak and his Singapore counterpart, Lee Hsien Loong, yesterday.

This came as a surprise as the news coming out of the toll industry recently has been more toll rate increases rather than decreases. While the rate reduction of 30% is substantial, we do not expect much impact to PLUS earnings as the Second Link contributes about 4% to total toll collection. The Second Link is not highly utilised at 14% only, and a lower toll rate may effectively boost traffic volumes on the highway. There is a lack of clarity on compensation at this juncture. In the last toll rate revision for the Second Link, the concession period was extended  by 15 years to expire in 2038. We do not discount the possibility that compensation may again be in the form of non-cash compensation given the government’s drive to reduce its budget deficit and curb subsidies. It is also unclear whether the Second Link will obtain its scheduled toll rate increase every five years in this new arrangement. However, for the purposes of quantifying the impact to earnings, we have taken into account the lower toll rate and maintained its scheduled toll increase, while imputing a traffic growth rate of 8%, higher than our previous 5%. Based on our analysis, the impact to EPS is minimal at less than 1% for FY11 and FY12. Thus, no changes are made to our estimates. by 15 years to expire in 2038. We do not discount the possibility that compensation may again be in the form of non-cash compensation given the government’s drive to reduce its budget deficit and curb subsidies. It is also unclear whether the Second Link will obtain its scheduled toll rate increase every five years in this new arrangement. However, for the purposes of quantifying the impact to earnings, we have taken into account the lower toll rate and maintained its scheduled toll increase, while imputing a traffic growth rate of 8%, higher than our previous 5%. Based on our analysis, the impact to EPS is minimal at less than 1% for FY11 and FY12. Thus, no changes are made to our estimates.

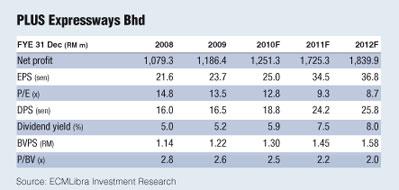

We maintain our buy call on PLUS with an unchanged target price of RM3.98 based on a dividend discount model (cost of equity of 6.2%, long term growth rate of 1.5%) pending more details regarding the toll rate reduction. We expect PLUS to achieve a 75% dividend payout ratio in FY10, in line with its headline KPIs. We like PLUS for its (1) attractive dividend yields, (2) 37.9% earnings growth in FY11, and (3) potential growth via acquisitions. — ECM Libra Investment Research, June 23

|