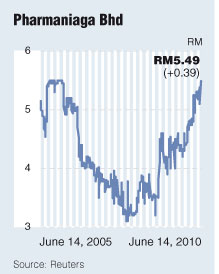

KUALA LUMPUR: Pharmaniaga Bhd closed yesterday at its highest level in over five years since Jan 24, 2005 after Boustead Holdings Bhd proposed to buy an 86.81% stake in the pharmaceutical company from UEM Group Bhd for RM534 million cash.

Pharmaniaga shares ended trading 7.65% or 39 sen higher at RM5.49 yesterday with 82,000 shares done. The counter had earlier gained as much as 42 sen to its intra-day high of RM5.52.

Meanwhile, Boustead closed at its intra-day high of RM3.68, up 2.79% or 10 sen with 1.11 million shares traded.

Trading in Pharmaniaga’s securities was halted late last Thursday while Boustead was suspended last Friday. Both counters resumed trading yesterday morning.

Boustead’s offer price for Pharmaniaga works out to RM5.75 per share, representing a 12% premium to its last traded price on Thursday of RM5.10.

Boustead will fund the acquisition via a combination of cash and borrowings. The cash portion will be from the recent sale of Boustead Insurance which raised about RM360 million.

In a research note yesterday, ECM Libra Investment Research said the purchase which would give Boustead a seventh division was a good business to go into, given its inelastic demand and defensive nature.

“Albeit not as profitable as oil palm plantations, it still holds long-term potential and the concession agreement will provide recurring income. Following the acquisition, Boustead hopes to grow the business, expanding regionally to Thailand and Indonesia,” it said.

ECM Libra said in terms of valuation compared to peers, Pharmaniaga was currently trading at a historical price earnings (PR) ratio of 9.1 times which was in line with peer average historical PE of 9.1 times. The highest PE within the sector was CCM Duopharma at 11.2 times, it said.

Boustead’s purchase price of RM5.75 translated to a PE of 10.2 times based on FY09 EPS, it said.

“Annualising 1QFY10 EPS gives a P/E of 16.5 times which appears quite high, but then again Pharmaniaga had a weak 1Q due to the temporary revocation of its manufacturing licence.

Using consensus FY10 EPS of 68.5 sen gives a more reasonable P/E of 8.4 times. Based on this, we view the purchase price paid to be fair,” it said.

ECM Libra maintained its buy call on Boustead at RM3.58 with a higher target price of RM4.48 versus RM4.14 previously. |