Upgrade to buy at RM4.24 with target price of RM4.91: We considered trimming our FY11 estimates to reflect cannibalisation from Berjaya Sports Toto’s (BToto) punters shifting some of their bets to illegal sports betting during the 2010 World Cup.

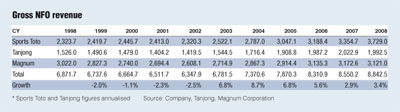

Historically, this amounted to 4%-5% reduction in revenue per draw during the World Cup period. However, we noticed that the number forecasting operator (NFO) industry grew by 6% in 2006 despite the World Cup then because it was held in a different time zone, foreign workers were not deported and the regulatory environment then was favourable.

We deem the operating conditions surrounding the 2010 World Cup to be similar to that of 2006. Therefore, we maintain our earning estimates.

Although BToto is not expected to receive much from the touted 1% on retail sales commission payable by sister company Ascot Sports, we believe legalised sports betting will actually boost revenues.

Taking a leaf out of history, increased outlet visits driven by large jackpots led to higher revenues for both lotto and non-lotto games (4D, 5D and 6D).

In the same vein, we expect increased outlet visits driven by sports betting to again lead to overall revenue growth as punters who are not regular NFO punters bet on not only sports but mainstay NFO games.

More importantly, that little cannibalisation effect World Cups have had on BToto’s revenue will be arrested once and for all. More importantly, that little cannibalisation effect World Cups have had on BToto’s revenue will be arrested once and for all.

We assumed a 15% reduction in revenue per draw for FY10 due to competition from Magnum’s 4D Jackpot. Thereafter, we assumed 2% growth in revenue per draw (1998-2008 NFO industry compound annual growth rate: 2.6%).

Our unchanged target price of RM4.91 (terminal growth rate: 1.5%, weighted average cost of capital: 7.9%) currently offers 16% upside potential and 5.4% net dividend yields.

Thus, we revert back to our earlier buy call. We would also like to point out that BToto’s share price is resilient during recessionary periods and periods of low consumer confidence due to its stable earnings (assuming stable prize payout ratios) and attractive dividend yields.

With the upcoming subsidy rationalisation programme, BToto will provide a “safe harbour” for investors. — ECM Libra Investment Research, June 3 |