Petronas Gas Bhd

(Feb 19, RM9.79)

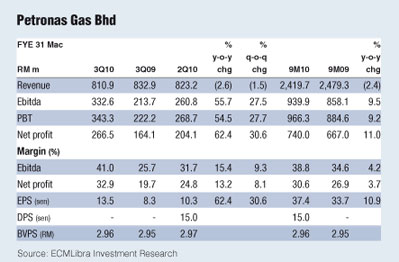

Maintain buy at RM9.78, target price RM10.80: Petronas Gas Bhd’s (PetGas) annualised net profits for 9M10 came in line with house as well as consensus estimates. For the nine months, the group reported revenue that was lower year-on-year (y-o-y) because of lower throughput but bottom-line has come through stronger as we expected.

Net profit for the quarter was 62% higher y-o-y and 31% higher quarter-on-quarter (q-o-q) driven predominantly by the centralised utilities and facilities (CUF) segment.

For the quarter, throughput revenue was softer y-o-y and q-o-q owing to continued low propane and butane prices and demand for the said products. However, margins from the segment picked up nonetheless by  15.4% y-o-y owing to plant efficiency. 15.4% y-o-y owing to plant efficiency.

Looking at the CUF segment, revenue held up this quarter and bottom line also improved owing to the same reasons.

The next gas processing and transmission agreement (GPTA) is due to be announced come April 1 and so far the market exhibits mixed feelings on the outcome.

Many are concerned that the fixed charge will be lowered hence putting a dent into PetGas’s core earnings. While it’s anybody’s guess, we believe that the GPTA will either be matched or be slightly more favourable.

Our expectations come from the previous GPTAs which all yielded a jump in earnings for the group. After all, PetGas pays good and steady dividends to its parent and we see no valid reason why Petronas would want to change that.

In view of the satisfactory results, we have left earnings estimates unchanged and view our year-end numbers achievable. We maintain our buy call and await news on the new terms of GPTA4 to be announced by the end of FY10.

Our target price of RM10.90 is based on FY10 earnings per share (EPS) pegging a 22 times price-to-earnings (PE). We continue to use FY10 as the denominator as FY11 earnings would be determined by the GPTA4, which for now, remains fluid.

To note, no dividends were declared for the quarter. Typically, a final dividend would be announced in 4Q that should make up for our full-year estimates of 42 sen or a 85% payout. — ECMLibra Investment Research, Feb 19

This article appeared in The Edge Financial Daily, February 22, 2010.

|