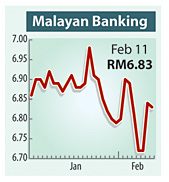

ECM Libra raised the target price for Malayan Banking Bhd to RM8.30, after the lender posted a better-than-expected first half financial results.

For the first half ending June 30 2010, it posted a net profit of RM1.88 billion, making up 60 per cent of ECM Libra's expectations and 62 per cent of consensus expectations.

The better earnings was driven by improved loan volume and net interest margin, as well as stronger performances in its investment banking and treasury operations.

"The group's two largest offshore exposures, Singapore and Indonesia, continue to benefit from recovering economic and lending activity, with the former registering a year-on-year (y-o-y) growth of +8.0 per cent, while the latter grew at +18.0 per cent  y-o-y owing to strong sequential growth. y-o-y owing to strong sequential growth.

"To further strengthen its Indonesian operations and augment its growth, the group through BII has announced their intention to embark on a rights issue to raise proceeds of up to US$150 million (RM513.5 million). The amount is well within the Group's ability to subscribe given its healthy cash pile and we view this exercise positively as the market still has much to offer in terms of longer-term growth," said the research house.

It maintained "Buy" call on the lender, and has raised its target price as well as earnings forecasts.

|