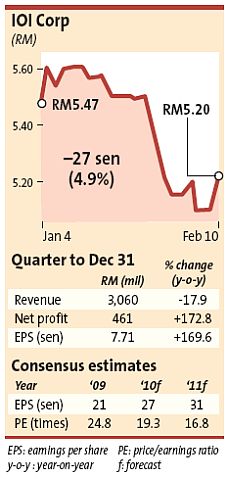

PETALING JAYA: IOI Corp Bhd reported a 173% surge in net profit to RM461.2mil for the second quarter ended Dec 31, 2009 due to higher contributions from its property and manufacturing segments as well as unrealised translation gains on US dollar-denominated borrowings.

However, its revenue declined 17.9% to RM3.1bil compared with RM3.7bil in the previous corresponding period, the company said in a filing with Bursa Malaysia yesterday.

Analysts said the second-quarter results were generally above expectations.

An analyst with ECM Libra Research said the group had surprisingly posted a good set of numbers but could not immediately confirm if IOI Corp’s ratings would be changed following the release of the second-quarter results.

ECM Libra currently has a “hold” call on the counter with a target price of RM5.21.

IOI Corp’s plantation division reported a 39% drop in operating profit to RM319.9mil for the second quarter compared with RM527.8mil a year earlier as a result of lower crude palm oil (CPO) prices as well as lower fresh fruit bunches production.

The group said average CPO price realised for the second quarter were RM2,225 per tonne compared with RM3,081 in the corresponding quarter.

Meanwhile, IOI Corp’s resource-based manufacturing division reported an operating profit of RM145.4mil in the second quarter compared with a loss of RM85.3mil previously.

Its property division’s operating profit of RM125.4mil in the second quarter was more than twice the profit reported in the previous corresponding period.

“The significantly higher profit is contributed mainly by increased sales of high-end residential and commercial properties in the Klang Valley,” it said.

On its outlook, IOI Corp said the global economy had been showing signs of improvement but the current financial year remained a challenging period for businesses.

“Nevertheless, the group is optimistic to perform better in the current financial year,” it added. |