AMMB Holdings Bhd

(Feb 9, RM4.72)

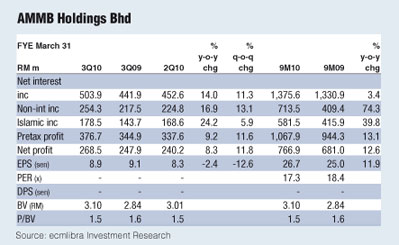

Reaffirm buy at RM4.61, target price at RM5.24: The group’s net profit of RM766.9 million for first nine months of its FY10 ending March 31 (9MFY10) came in within expectations, making up 77% of our estimates on an annualised basis.

Strong income growth (both net interest and non-interest) on the back of a rapid expansion in its loans book as well as the recovering capital markets contributed to a record quarter, which saw the group reporting its highest ever net profit of RM268.5 million.

The group’s loan base continued on its expansionary path after previous quarters of anaemic activity, registering a quarter-on-quarter (q-o-q) growth of 5.5% for the current quarter and following the previous quarter’s strong 3.4% q-o-q growth.

On a year-on-year (y-o-y) basis, growth naturally expanded at a strong 11.1%, the first time it has registered double-digit growth in a while. On business segment contributions, the retail banking division saw a 2.8% growth on a net basis, while the business banking division recorded a 13.7% y-o-y growth.

Investment and trading income benefited strongly from improving equity and capital market conditions, and helped turn investment banking contribution from an RM9.8 million pre- tax loss to a RM149.5 million gain in the current nine-month period. tax loss to a RM149.5 million gain in the current nine-month period.

Stronger brokerage fee and commission helped the group register higher fee income of RM421.2 million for 9MFY10 versus RM355 million in 9MFY09 while improving capital market conditions saw the group reversing its losses from sales of securities held-for-trading and revaluation of derivatives (RM75.8 million and RM74.6 million respectively in 9MFY09) to gains of RM38.3 million and RM22.5 million respectively. Cumulative effects of all these reversals saw the group registering a strong RM620.6 million non-interest income in nine-month period under review, almost double the RM324.7 million in the previous corresponding period.

The assurance unit meanwhile registered higher profit during the quarter on the back of higher premiums underpinned by enhanced agency network and focus on product bundling and cross-selling.

While growth in the business segment is most impressive especially against the backdrop of a still-weak global economic environment, we raise a slight caution on the fact that it could act as a double-edged sword in the coming quarters.

The group continues to show consistent operational earnings improvements and we continue to like its growth prospects over the medium term. We reaffirm our buy call and target price. Forward price-earnings ratio (PER) remains inexpensive at 12.3 times while price earnings-to-growth (PEG) is at an undemanding 0.85 times. — ECM Libra Investment Research, Feb 9

This article appeared in The Edge Financial Daily, February 10, 2010.

|