SapuraCrest Petroleum Bhd

(Jan 14, RM2.48)

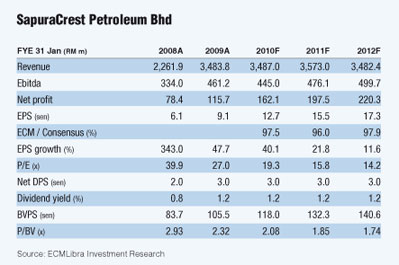

Maintain hold at RM2.45, target price cut to RM2.48: We maintain our hold call with a slightly reduced target price to RM2.48 from RM2.57 with the change in earnings estimates. This is based on a 16 times price earnings (PE), which has been their historical average since returning to the black in 1Q08, pegging FY11 estimates.

We adjust down FY11F numbers by 3.9% to reflect our bearish outlook on the marine services segment but upgrade FY12F numbers on a recovery in that segment, as well as positive earnings from its heavy lift and pipelay barge, Sapura3000, and the installation of pipelines and facilities (IPF) segment.

FY10F numbers are unchanged. We note that upcoming 4Q10 results could be softer than 3Q10 due to the monsoon season.

We recently met with SapuraCrest for updates and feel the company was on an uptrend, especially with the Sapura3000 now turning in profits and better earnings visibility for the IPF segment with the production sharing contractors (PSC) umbrella job, which could essentially be worth up to RM7 billion to RM8 billion if the contract is fully extended for five years.

Our margin expectation for the job is at least 7% at earnings before interest and tax (Ebit) level. Additionally, the group will have two new vessels under joint-venture ownership to use  for this job, hence this reduces the uncertainty of margins from having to charter third-party vessels. for this job, hence this reduces the uncertainty of margins from having to charter third-party vessels.

SapuraCrest has had an uphill climb in recent years in terms of earnings progression and we see the company has just in recent quarters realised it’s potential. The profile of jobs the group has been getting serves as a testament to its expertise as well as market traction.

However, we believe that this improvement has been priced in; hence, upside for the stock at this juncture looks limited.

The negative with SapuraCrest’s earnings for now will be the marine segment, which during 3Q10 reported a RM21 million loss due to severe vessel under-utilisation of less than 50%.

The drilling segment, which is the “gem” of SapuraCrest given the good margins and steady recurring income is also expected to see some changes going forward. Out of five tender assist rigs, two will be up for renewal this year at a maximum 20% lower than previously negotiated. Nonetheless, we still expect the segment to be a key contributor to the group. — ECM Libra Investment Research, Jan 14

This article appeared in The Edge Financial Daily, January 15, 2010.

|