Malaysian Airline System Bhd

(Jan 13, RM3.04)

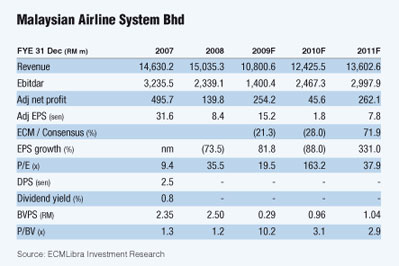

Maintain sell at RM3.06, target price revised to RM2.21 (RM1.90 ex rights): Despite the nascent uptrend in the passenger traffic and revenue yield, MAS’ rights issue will result in significant earnings dilution. As such we maintain our sell call.

We are changing our valuation method to enterprise value/earnings before interest, tax, depreciation, amortisation, rent/restructuring costs (EV/Ebitdar), which tracks the valuation of an airline against its operational performance.

Pegging a 5.1 times target based on the average EV/Ebitdar of its regional peers, we drive our new target price of RM2.21.

Price-to-earnings ratio (PER) is virtually irrelevant, as the company has made losses for five out of 10 financial years. Price-to-book value (P/BV) is also not a good method now following the adoption of FRS139, which resulted in a significant writedown of book value due to the recognition of unrealised mark-to-market derivative losses.

As such, we adopt EV/Ebitdar valuation, which tracks the valuation of an airline against its operational performance.

MAS’ historical EV/Ebitdar is not a good benchmark as the artificially low debt levels post its widespread asset unbundling exercise in 2002 resulted in the sharp drop of EV/Ebitdar.

Since MAS will be aborting its asset light business model and more debt and aircraft will be brought onto its balance sheet going forward, we suggest using the average EV/Ebitdar of its regional peers which also have similar strategy.

We have previously ignored the effect of the early adoption of FRS 139 in our earnings model to facilitate comparison with AirAsia. However, in view of its mandatory adoption with effect from Jan 1, we have restated our earnings model for MAS by accounting for the effect of FRS 139.

Our revised earnings estimates also take into account: (1) additional depreciation and borrowing costs from aircraft acquisitions; (2) lower aircraft lease expenses; and (3) effect of earnings dilution from the proposed 1-for-1 rights issue. The net effect of these resulted in significant earnings per share (EPS) dilution in FY10 and FY11 as we only factor in 5% growth in passenger seat capacity (available seat per km).

While new aircraft are expected to be operationally more efficient, the benefit is not expected to be seen in MAS’ bottom line yet until capacity and passenger traffic can be ramped up in a significant manner.

We believe MAS is at an inflection point, operation-wise. Load factor has bottomed out in 1QFY09 when it hit 56.1%. Capacity cut seems to have stabilised and reached a manageable level given current demand while passenger traffic has been on an uptrend since 2Q09.

Although the increase in passenger traffic growth in 2Q09 was due to aggressive fare cutting, revenue yield (revene/revenue passenger per km) has rebounded strongly in the subsequent quarter.

Acquisition of new aircraft is unlikely to add significantly to MAS’ fleet size of 81 aircraft in the immediate term. We expect new aircraft deliveries will be deployed to replace aging aircraft currently leased from its parent.

However, we believe MAS has the flexibility to continue leasing existing aircraft should demand pick up faster than expected. Thus, we believe MAS has the leverage to boost its fleet from existing 81 to 147 by FY2016. — ECM Libra Investment Research, Jan 13

This article appeared in The Edge Financial Daily, January 14, 2010

|