THE potential “marriage” between Hong Leong Bank Bhd (HLB) and EON Capital Bhd (EON Cap) will help to boost the former’s growth domestically and put it in a stronger competitive position in the face of liberalisation.

The merger will catapult HLB into the fourth largest bank in terms of assets in the country from its current sixth position.

The scale and size will also provide HLB with greater financial muscle to meet its aspirations as a regional player.

On the homefront, HLB will end up with a wider deposit-taking and loans franchise via a network of 338 bank branches nationwide (HLB and EON Cap currently has 199 and 139 bank branches respectively).

It will also enable the group to achieve better economies of scale in certain areas such as CASA (current account savings account) deposits, hire purchase (HP) and mortgages thus providing better pricing for consumers.

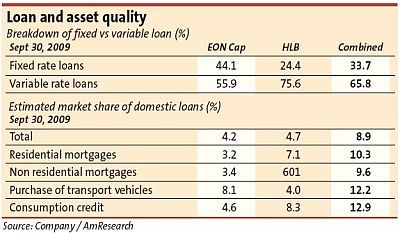

For individual segments, EON Cap has an estimated market share of 8.1% in the auto loan segment, while HLB’s is about 4.0%.

On a combined basis, the merger will raise the auto loan market share to a substantial 12.2%.

TA Research notes that EON Cap can help boost HLB’s small and medium enterprise (SME) business, which had not been growing very significantly over the past year.

HLB’s market share in the SME segment currently stands at a paltry 2.5% while EON Cap has around 4.8% of the industry’s total SME loans as at Sept 30, 2009.

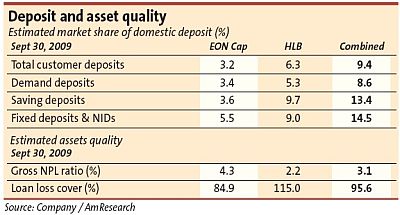

In addition, AmResearch estimates that HLB’s market share of residential mortgage will be lifted to 10.3% from 7.1%.

“HLB’s profile of loans in terms of variable versus fixed rate loan will be rebalanced to 65.8% variable rate loan from the high of 75.6% currently,” it notes.

HLB’s current share of the local deposit market is 6.3%, but with this merger it will be boosted to 9.4%.

In terms of non-performing loans (NPLs), EON Cap’s transformation exercise which started in mid-2007 has helped to reduce its NPLs.

The group’s kitchen sinking exercises have resulted in a lower net NPL of 2.5% in the third quarter of 2009 (3Q09) versus 4.2% in 4Q07 and loan loss cover raised to 84.9% in 3Q09 (4Q07: 58.1%).

This will help to ensure that HLB’s asset quality, said to be one of the best in the banking sector, is not compromised.

ECM Libra points out that loan loss provisions have hardly made a dent in HLB’s earnings every quarter as it remains relatively small - RM162mil for financial year ended June 30, 2007 (FY07), RM159mil for FY08 and RM190mil for the nine months ended Sept 30, 2009 - in comparison with its total loans portfolio of over RM35bil.

“HLB’s net NPL ratio continues to improve, falling to 1.22% in the first quarter ended Sept 30, 2009 from 1.34% in the fourth quarter ended June 30, 2009, an achievement made all the more remarkable given the tepid growth in its loans book,” ECM Libra says.

EON Cap’s liquidity appears to be rather tight with a loan-to-deposit (LD) ratio in excess of 96% while HLB’s LD ratio hovers around 55%, the lowest in the industry.

The merger will help boost HLB’s low LD ratio which has resulted in a weakening in net interest income in recent quarters as well as EON Cap’s loans growth which is limited by its high LD ratio.

That said, OSK cautions that EON Cap’s inferior capital position and liquidity ratios will dilute HLB’s superior capital ratios.

Moreover, EON Cap’s weaker asset quality can give rise to a potential increase in NPLs and provisions, it notes.

Some analysts opine that apart from the kitchen-sinking of non-performing loans, EON Cap’s transformation programme had not improved its market positioning and franchise strengths.

“HLB’s transformation programme has worked very well for it. Given time, EON Cap’s transformation may be just as good especially if the merger takes place,” an analyst reckons.

HLB’s Business Transformation Programme which started in 2004 was a success and had helped the bank to make its first billion in pre-tax profit in FY08 as well as reduced NPLs.

The programme which focused on sustainable profitable growth scaled up the bank’s infrastructure and foundation and developed new capabilities. |