CIMB Group Holdings Bhd (Dec 31, RM12.84)

Reaffirm buy at RM12.92, target price raised to RM15.25: CIMB Group announced on Dec 30 that its unit, CIMB Bank is selling 65 properties to the Employees Provident Fund (EPF) for RM302.45 million. The transaction is a win-win situation for both companies.

We are in full agreement that CIMB Group is not in the business to own properties and that the transaction will, among others, reduce risk-weighted assets by the book value of the properties and generate Tier-1 capital for CIMB Bank by the net gain from the disposal of properties.

The expected gain of the sale will be up to RM171 million when completed in 1Q2010.

EPF will be purchasing investment properties yielding returns in excess of 7% per annum over the next 15 years and beyond, and thereby generating consistently higher returns for its contributors, while CIMB Group will be unlocking RM302.45 million worth of asset value and raising cash for its working capital purposes.

Upon completion of the sale, CIMB Group (through CIMB Bank) will lease back the properties from EPF on a three-term five-year triple net lease basis. Initial lease rate for the first term will  be 7% per annum, the second term at 7.35% per annum while the third term will be at 7.7175% per annum. be 7% per annum, the second term at 7.35% per annum while the third term will be at 7.7175% per annum.

CIMB Bank may extend the lease period beyond the initial 15 years, subject to a lease escalation of 5% for each subsequent extension.

We continue to be positive on CIMB Group’s medium- to longer-term prospects as its sets out to enhance its regional footprint and growth.

CIMB Group also remains poised to benefit the strongest from a return of capital market activities.

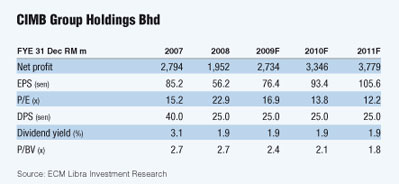

Our FY10 earnings is adjusted upwards by 5.3% to reflect the net gain from the sale. Given the corresponding rise in FY10 book value to RM6.10, our target price is adjusted marginally higher to RM15.25 premised on an unchanged 2.5 times multiple. — ECM Libra Investment Research, Dec 31

|