Hong Leong Bank Bhd’s results for the first quarter ended Sept 30, 2009 (1QFY10) was within analysts expectations, although they were mixed on their recommendations for the bank’s stock.

Kenanga Research said: “1QFY10 net profit was heartening, which saw higher PAT (profit after tax) by 18% on a quarter-on-quarter (q-o-q) basis driven by stronger top line and lower credit charge.”

It said the bank’s net interest income of RM335 million was supported by the loan growth of 1% q-o-q.

“There were some positives in the quarter, including higher net interest margin (NIM) at 1.79%, (4QFY09: 1.6%), as HLB benefited from lower deposit which declined 3.7% q-o-q. Asset yield stood at 3.33% (vs 4QFY09: 3.26%) with cost of fund lower to 1.67% (vs 4QFY09: 1.77%). With NIM stabilising, the group had likely passed its worst with the bank now able to reprice its deposit base faster than asset yield drop,” the research house said.

“We believe HLB bought into Chengdu City Commercial Bank as part of its diversification strategy. The acquisition would change existing business composition significantly with earnings contribution from Chengdu City Commercial likely to be significant with an estimated contribution of RM100 million (pre-tax). 1QFY10 Chengdu Bank contributed RM30.5 million, was in line with guidance,” it said.

Kenanga called a trading sell on the stock at RM8.35, valuing it at RM7.90 as it applied 1.8 times book value of RM4.40, a discount to its historical mean of 1.9 times but in line with the sector average of 1.6 times.

It also said it was turning optimistic as management guided that NIM was stabilising, while with the most asset-sensitive balance sheet in the sector, earnings would be biased upwards given the upside possibility to overnight policy rate next year.

“NIM recovery is likely to be the key catalyst,” it said.

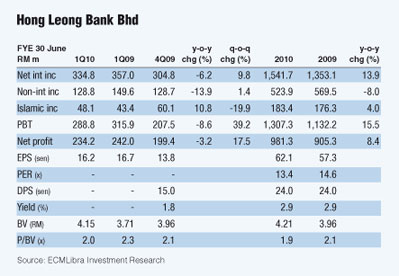

Meanwhile, ECM Libra Research said there were marked slowdowns in certain loan segments, which saw both year-on-year and q-o-q contractions.

“Hire purchase loans (13.1% of total portfolio) contracted by 6.8% y-o-y, while also slipping 2.5% on a q-o-q basis. Working capital loans shrank 4.7% on a y-o-y basis while slowing to a 0.5% growth on a quarterly basis. Were it not for the mortgage loan segment (39.5% of total portfolio), which grew 4.2% y-o-y and 2% q-o-q, the group’s overall loans book may well have contracted for the quarter,” it said.

It added, however, the formation of new NPLs in the current quarter had fallen to pre-financial crisis levels, an encouraging sign that the weakest economic conditions had passed.

“The group’s share price has had a strong run in recent weeks on the back of privatisation and/or takeover talks, and also optimism surrounding its further moves into China, of which its current venture has proven very successful,” it said.

It said on a quantitative basis, however, the group had not exhibited sufficient near-term growth impetus to be overly-excited about, other than potentially higher dividend payouts given the current utilisation of its balance sheet and slight “over-capitalisation”.

“While we are raising our target price to RM8.71 based on 1.92 times of its CY10 book value to reflect the current buoyant sentiment surrounding banking stocks, we are maintaining our hold call,” it said.

|