ECM Libra Research has maintained its hold call on Star Publications Bhd at RM3.34 with an unchanged target price of RM3.36 after the media group’s third-quarter (3QFY09) results came in below expectations.

“We maintain our target price at RM3.36 which would yield a price-to-earnings (PE) of 15.3 times based on our forward earnings per share (EPS) of 21.9 sen,” it said in a recent note.

ECM Libra also noted that Star’s huge cash pile of RM721 million and potentially attractive dividend payout (FY09 projected yield at 6.6%) remained pull factors, and it believed the group’s performance would improve from the final quarter onwards.

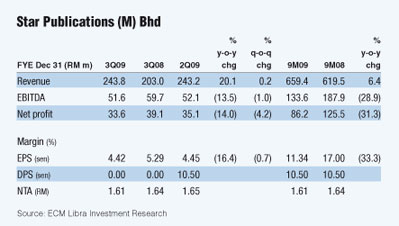

Star reported a 17.3% drop in pre-tax profit (PBT) to RM46.6 million in 3Q compared with RM56.3 million a year earlier. Net profit fell 14% year-on-year (y-o-y) to RM33.6 million from RM39.1 million previously.

On a cumulative nine-month basis, Star posted a PBT of RM119.3 million (-32.8% y-o-y) and a net profit of RM86.2 million (-31.3% y-o-y).

Revenue, however, showed double-  digit gain despite the decline in earnings. Star’s 3Q revenue came in at RM243.8 million, 20.1% higher compared with RM203 million a year earlier and a marginal gain of 0.2% from 2Q. Fro the nine-month period, revenue totalled RM659.4 million, a 6.4% increase from 9M08. digit gain despite the decline in earnings. Star’s 3Q revenue came in at RM243.8 million, 20.1% higher compared with RM203 million a year earlier and a marginal gain of 0.2% from 2Q. Fro the nine-month period, revenue totalled RM659.4 million, a 6.4% increase from 9M08.

“The higher revenue was due to continued improvement in advertising expenditure (adex) in the 3Q. The Hari Raya holidays in September would have contributed positively to the improved y-o-y and q-o-q (quarter-on-quarter) performance in terms of revenue,” said ECM Libra.

“The fall in profits was due to lower revenue from the print and electronic media division and higher printing cost and other cost of sales from the event management and exhibition services segment,” it added.

ECM Libra said signs of recovery in the economy could result in further improvement in adex figure for 4Q09.

“Adex should also get a boost considering that the Christmas and New Year holidays fall in the last quarter. And this usually results in more advertisements being placed,” said ECM Libra.

Additionally, the research firm said Star could benefit from a possible decline in newsprint cost in 4Q, given that newsprint prices had fallen since late June. Industry players had indicated that higher-cost newsprint stock should have been used up in 3Q, and this would result in falling costs in 4Q.

To the benefit of Star, the research firm added that newsprint prices fell from late June onwards. Industry players have indicated that the higher cost old newsprint stock should have been used up in 3Q and this would result in falling costs in 4Q.

Last Friday, Star fell three sen to close at RM3.31.

|