ANALYSTS have maintained their buy call on PUBLIC BANK BHD following the release of its results for the third quarter ended Sept 30, 2009, which came in largely in line with consensus estimates.

In a recent note, Kenanga Research said Public Bank’s net profit for the nine months to Sept 30 of RM1.84 billion was in line with full-year consensus estimates, representing 77% of consensus estimates of RM2.4 billion, and marginally above the research house’s own estimates, making up 82% of its RM2.25 billion projection.

Its net profit in 3QFY09 of RM639 million was also not too far off from 1QFY09’s RM611 million, and despite the cut in the overnight policy rate (OPR) in 1Q09, the banking group was able to increase its net interest margins to 2.04% from 2.02% in 2QFY09.

The research house said the bank’s net profit for the nine-month period was “commendable” given the current economic environment, while there was no sign of rising non-performing loans.

Kenanga also maintained its full-year credit cost assumption for Public Bank, of between 27 basis points (bps) and 28bps.

It added that the bank’s key top line numbers were also strong, mainly due to a 3.2% quarter-on-quarter (q-o-q) and 13.4% year-on-year (y-o-y) growth in loans, sustained efficiency, with a low cost to income ratio of 34.2%, and solid loan loss coverage ratio of 171% among others.

The bank achieved a net earnings growth of 3.7% y-o-y and 4.6% q-o-q, which Kenanga believed was better than most of its regional peers.

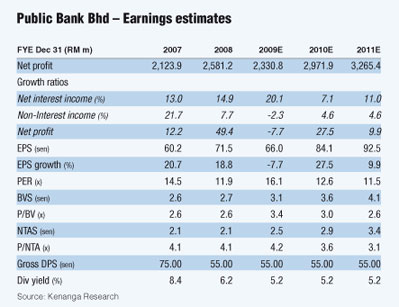

“We revise upwards our earnings forecast by 4% for FY09-FY10 to factor in higher fee income contribution. Also, we do not rule out the possibility that an interest rate hike will  increase net interest income, given the higher loan and deposit growth. increase net interest income, given the higher loan and deposit growth.

The research house reiterated its buy rating for Public Bank and raised its target price marginally to RM12.10 from RM11.90 previously, using a targeted 3.4 times price-to-book value (P/BV), being a premium to the sector average of 1.8 times.

“We believe this is justified due to its track record on its earnings growth and capital management initiatives. The bank should achieve last year’s dividend payout of 55 sen cash and 21.1 treasury shares, or a yield of at least 8%-10%,” it said.

Meanwhile, ECM Libra Investment Research said Public Bank’s nine-month to Sept 30 results were slightly below its expectations.

“We were made to understand that this was due in part to a reclassification and more stringent provisioning in one of its overseas operations, which would have otherwise seen the results coming closer to estimates,” it said.

The research house, however, maintained its earnings estimates for the bank’s full-year results, despite the “slight underperformance”, which it believed would be adequately made up for in 4QFY09.

It also expected the bank’s future loans growth to stabilise within the 12%-15% range, with economic fundamentals on the mend.

The bank was also expected to maintain its focus on its mortgage, hire purchase and small and medium-sized enterprise sectors to drive loans growth, which ECM Libra was positive on given the benign default rates those segments showed, and hence were not likely to pose significant risk to asset quality.

As at Sept 30, 2009, the bank’s NPLs stood at 0.82%.

“We continue to like Public Bank for its superior ROEs (returns on equity) and above-average growth prospects despite its seemingly rich valuations. Our buy call is reaffirmed,” it said, in pegging a target price of RM12.80 for the bank’s stock.

Last Friday, Public Bank closed at RM10.66, up four sen.

|