KUALA LUMPUR: Malaysia Airports Holdings Bhd (MAHB), which has been at loggerheads with AIRASIA BHD [ AIRASIA 1.500 0.000 (0.000%)] over the timeline for the completion of the new low-cost carrier terminal (LCCT), said yesterday the terminal would be ready by the third quarter of 2011 (3Q2011), dispelling any notions of a possible delay.

AirAsia, on its part, said if that was the case, it would stick to and may even accelerate its fleet expansion plans.

AirAsia group chief executive officer Datuk Seri Tony Fernandes told The Edge Financial Daily yesterday that while the budget carrier had confirmed the deferment of eight aircraft next year, it had yet to decide on its delivery for 2011.

“We are only contemplating the deferment for 2011, we have not confirmed. We may even accelerate the delivery of Airbus A320s if the LCCT is ready on time,” he said here yesterday.

An MAHB spokesperson told The Edge Financial Daily that it was standing by the 3Q11 deadline for the completion of the new LCCT. “That (3Q2011 deadline) is what we have committed to the government and we will deliver,” the spokesperson said.

The MAHB official was responding to questions on the timely completion of the LCCT, which AirAsia doubts. The airline had said it was deferring the delivery of several planes due next year because it was uncertain that the terminal would be ready as scheduled.

Fernandes said AirAsia would not incur a penalty for deferring delivery of the aircraft.

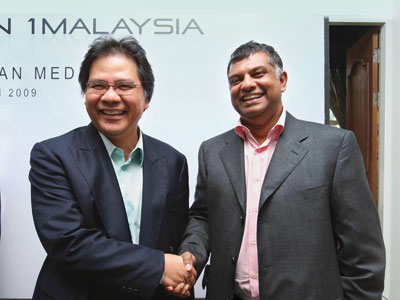

ALL FOR ONE: MAS MD & CEO Datuk Seri Idris Jala (left) and AirAsia group CEO Datuk Seri Tony Fernandes, who are fierce rivals often at odds in the aviation business, in a chummy mood at the launch of Yayasan 1Malaysia yesterday. They are among eight prominent Malaysians who formed the non-profit foundation dedicated to national unity initiatives. Photo by Mohd Izwan Mohd Nazam ALL FOR ONE: MAS MD & CEO Datuk Seri Idris Jala (left) and AirAsia group CEO Datuk Seri Tony Fernandes, who are fierce rivals often at odds in the aviation business, in a chummy mood at the launch of Yayasan 1Malaysia yesterday. They are among eight prominent Malaysians who formed the non-profit foundation dedicated to national unity initiatives. Photo by Mohd Izwan Mohd Nazam

“We will have to give Airbus an 18-month notice if we decide to defer and we don’t have to pay (any penalty) for the deferment,” he said here yesterday after the launch of Yayasan 1Malaysia, a non-profit foundation dedicated to national unity initiatives.

It has been reported that AirAsia may defer the delivery of eight A320s, out of the 24 scheduled for delivery next year.

However, it is unclear whether the deferred eight planes will be delivered in 2011, when AirAsia is already scheduled to take delivery of another 24 planes.

Fernandes reportedly said the deferment was due to doubts on the timely completion of the new LCCT. He had denied that the move was due to funding or cash flow issues.

Tight credit and dwindling travel demand have crippled the global airline industry, which is expected to see a loss of some US$9 billion (RM32.31 billion) this year, based on International Air Transport Association (IATA) estimates.

In such a scenario, AirAsia’s deputy CEO Datuk Kamarudin Meranun said there was unlikely to be a demand for AirAsia’s delivery slots. Under normal circumstances, airlines can gain from selling delivery slots.

AirAsia made its latest 25 firm orders in 2007, bringing its total orders of the A320 to 175 with another 50 on option, making it the largest customer for the A320 aircraft. As of June, it was operating 45 A320s.

HwangDBS Vickers Research said in a note yesterday that the deferment could be “a signal of over-capacity situation”, apart from the risk of the new LCCT completion.

“Note that in 1Q09 load factor fell 2.4 percentage points year-on-year to 70% as total capacity (available seat/kilometre) rose by 19%. We have not factored this in our forecasts pending details on the negotiations,” it said.

OSK Research said AirAsia’s plan to defer taking the aircraft “certainly reflects the less than exciting outlook for the LCC”, in view of the rebound in crude oil price and the fact that the airline had unwound all its fuel hedge positions.

RHB Research said it was premature to turn positive on airlines, including AirAsia, as demand for air travel would remain weak on the back of the global economic slowdown and the influenza A (H1N1) outbreak.

It said the massive new capacity coming on stream from both full-service and budget airlines in the region over the short term would intensify competition and depress yields.

ECM Libra Research said although AirAsia’s planned deferment of the eight aircraft next year may cap earnings for 2010, it would help lighten the load of the group’s debt obligations.

“AirAsia’s gearing level (total debt to equity, excluding deferred tax assets) is expected to be five times in FY10.

“However, the deferment of the eight Airbus aircraft will reduce it a little to a gearing level of approximately 4.3 times. We also expect its cash balances to improve in FY10 as a result of the deferment,” it said in a note. |