ECM Libra Investment Research has upgraded the construction sector to neutral from underweight, saying it would be the main beneficiary of the second stimulus package, but it has maintained its neutral call on building materials. ECM Libra Investment Research has upgraded the construction sector to neutral from underweight, saying it would be the main beneficiary of the second stimulus package, but it has maintained its neutral call on building materials.

The government allocated another RM12 billion for infrastructure spending out of the total RM60 billion in the second stimulus plan announced last Tuesday. Together with RM4.1 billion already allocated under the first stimulus package, the construction sector received a massive boost of RM16.1 billion.

A significant portion of the additional RM12 billion allocation was for small-scale projects such as schools, road works and basic infrastructure.

“These projects will mainly benefit small contractors, the hardest hit group compared to the big listed contractors which continue to benefit from overseas jobs,”the research house said. “These projects will mainly benefit small contractors, the hardest hit group compared to the big listed contractors which continue to benefit from overseas jobs,”the research house said.

“Some jobs may still flow to the smaller cap listed contractors such as Ahmad Zaki (Resources Bhd) and TRC Synergy, which have significant exposure to government jobs as well as Protasco which specialises in road construction and maintenance. Sunway Holdings may also benefit from the demand for quarry aggregates used in road construction.”

It added that the construction of the new low-cost carrier terminal (LCCT) and the Penang airport expansion would benefit players such as WCT Bhd and TRC Synergy while the light rail transit (LRT) line extension and the tunnelling portion of the Pahang-Selangor water transfer projects would be beneficial for IJM Corp and Gamuda Bhd.

“Although the additional infrastructure spending will boost the construction sector, its benefit to the listed players may still be somewhat limited, more of stemming the slide rather than boosting its order book significantly. On the other hand, risk of further margin erosion is limited now as most have carried out kitchen sinking exercises in 4Q08,” it said.

However, it added that there were insufficient catalysts for an overweight call on the sector as it has to balance the positive of the second stimulus package with risk of lower order book replenishment from overseas as well as higher implementation risk now.

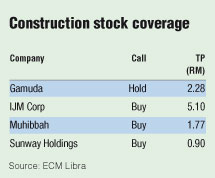

ECM Libra has a hold call on Gamuda with a RM2.28 target price (TP) while IJM (TP: RM5.10), Muhibbah Engineering Bhd (TP: RM1.77) and Sunway Holdings are buys (TP: 90 sen).

On the building materials sector, ECM Libra said it has been dragged down by a slowdown in construction. The research outfit maintained a neutral stance on the sector as the boost in the construction sector would trickle down to the building materials sector. On the building materials sector, ECM Libra said it has been dragged down by a slowdown in construction. The research outfit maintained a neutral stance on the sector as the boost in the construction sector would trickle down to the building materials sector.

“Cement and steel usually take up 5% and 15% of the cost of construction respectively. This will result in players within the industries getting an additional boost to their income stream. However, the impact will only soften the blow of the economic slowdown and not result in a growth spurt,” it said.

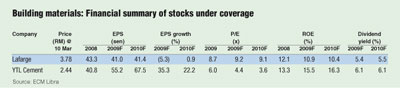

ECM Libra has revised cement maker Lafarge’s FY09 and FY10 earnings upwards by 4% and 9%, respectively, while FY10 earnings for YTL Cement has been forecast by a higher

9.5%.

The research house has a hold recommendation on Lafarge (TP: RM3.90) while YTL Cement is a buy (TP: RM4.50). |