Concerns linger on sustainability of future earnings

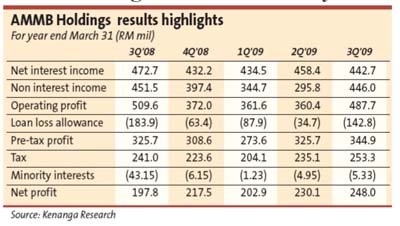

PETALING JAYA: AMMB Holdings Bhd has delivered an impressive net profit of RM248mil in its third quarter results for the financial year ending March 31, 2009, with significant improvement in non-interest income.

“Cumulative net profit for the nine months rose 51% year-on-year (y-o-y) to RM681mil and accounted for 87% of consensus estimates,’’ ECM Libra said.

However, ECM Libra noted a reduction in minority interests following the privatisation of AmInvestment Group Bhd.

“Y-o-y pre-tax profit growth of 6.6% is more reflective of the current difficult operating environment, which was aided in part by a RM95.5mil gain realised on disposal of equity interest,’’ it added.

TA Securities pointed out that sharply lower loan loss provisions and decline in tax expenses also helped boost cumulative profits.

Kenanga Research also cited lesser revaluation losses of RM36mil against RM81mil in the second quarter.

However, the banking group’s net interest margin was under pressure, it said, adding that loan growth for AMMB was strong, with the slack in the hire-purchase loan segment offset by increased activity in the business segment.

“AMMB intends to focus on the profitable segments in the hire purchase business,’’ said a spokesman from AMMB.

Analysts see challenges in the horizon for trade finance, the small business segment and retail banking opportunities as the economy goes into a downturn that is sharper than anticipated.

“In mitigating the impact, we have been prudent in our strategies to de-risk, diversify and achieve differentiated growth,’’ said the spokesman.

The non-performing loans (NPLs) situation in the industry is expected to deteriorate in the ensuing quarters as the unemployment rate rises.

TA Securities expects AMMB to be selective in its exposure to the consumer segment as consumer credit rose by a moderate 4.6% y-o-y, compared to the 19% y-o-y increase in business loans. Consumer loans, starting with credit cards, followed by hire purchase and mortgages, would be the first few segments to show initial signs of NPL deterioration as the economy worsens.

“For now, however, we believe that AMMB is still on track to achieve its net NPL ratio target of 2.5% for FY09,’’ said TA Securities.

“We are raising our FY09 net profit forecast by 21% to RM897.2mil (from RM743.9mil) on the back of AMMB’s buoyant loan growth of 9.2% (new loan growth target at 8%), and its lowering of total provisions by 22.2% to RM456.8mil from RM587.3mil (due to a combination of lower credit charges and higher bad debt recoveries).

“We do not, however, think the strong earnings momentum is sustainable due to the challenging economic conditions,’’ said TA Securities.

Catalysts for the stock include lucrative dividend payments on excess capital of RM5.1bil for capital management initiatives, an achievable return on equity target of 11%-12%, turnaround of the investment banking business, growth potential to capture market share and a strong shareholder in the ANZ banking group (which is still one of the double-rated banks in the world) to help it weather the economic storm, Kenanga Research said. |