Financial services and the capital market in Malaysia are in for a bumpy ride due to the global turbulence. And this has badly bruised the market sentiment.

LAM, a research head with a local mid-sized investment bank in the city, has been under a lot of stress lately. His bonus was frozen and promotion delayed “to an unspecified date” and worst still, the possibility of a pay cut looms in the horizon.

Lam is the sole bread winner in his family of three school-going children and a wife. A couple of years ago, when the equity market was booming, he moved into a bigger house in Damansara. He is now contemplating refinancing the housing loan, as rates are lower, to help ease his financial burden.

Lam has a master’s degree in finance and economics and he is keeping his fingers crossed that the global economy and the equity markets will take a turn for the better by the end of year or he may have to opt for another job or teach part time by relying on his experience and education.

Needless to say, there are many out there who face a similar predicament given the uncertain times.

Corporate deals dry up

Investment and corporate activities appear to be drying up largely due to financing (or lack of it) and lower valuations while niche and boutique investment banks are struggling to clinch deals. On the other hand, an industry player says that because some bulge bracket investment banks (IBs) are becoming more choosy in their mandates due to risk aversion, some of the clients they have turned down have turned instead to boutique IBs.

“When the big guys reject these deals, they tend to come to us. So, there’s an opportunity there. But the problem is scarcity of funding. Everyone is looking for money, but no one’s giving. A lot of deal flows involve fund raising,” laments an investment banker.

Acknowledging that is investment banker Tengku Zafrul Aziz, group director of K&N Kenanga Holdings Bhd who says, no doubt, these are challenging times. “Some companies are facing trouble raising funds. Sentiments are hurt. Others with cash are adopting a wait-and-see attitude as they feel there is more to come.

“We are in a cyclical business … we are prepared to ride out the storm,” he says.

But no where is the impact as severe as that involving US firms which have operations in Malaysia. It is reported that Merrill Lynch, one of the many victims of the US subprime crisis, has cut loose its equity research outfit in Malaysia to slash costs, although its investment banking and advisory outfit in Kuala Lumpur will continue. Several other foreign-owned brokerages that have implemented voluntary separation schemes have seen the departure of key equity research analysts.

In addition, several foreign firms with investment banking business in the country have implemented staff pay cuts to brace for the tough times.

“The situation in the investment banking arena is getting bad although not as bad as in Singapore, where investment banking activities have plunged dramatically. Investment bankers in the republic are already taking a pay cut and some are foregoing their bonuses.

“Promoters of companies seeking a listing in Malaysia continue to have unrealistic expectations on the valuation of their companies for the IPO (initial public offering), and therefore, are holding back their plans,” says an analyst.

Because of this, KSC Capital research director Choong Khuat Hock foresees fewer companies seeking a listing this year due to the global downturn. He points out that while sectors providing essential services and utilities have relatively stable earnings, these companies will likely hold out for market confidence to return and with that, improved valuations, before they decide to get a seat on the stock exchange.

There is data to reflect that. Of 31 IPOs that were approved last year (26: 2007), 10 listings have been completed while the rest are biding their time for a more suitable window, having received a time extension from the Securities Commission, given the current weak market sentiment.

Julian Chua, vice-president of Citi Investment Research (Citi Research) Asia Pacific equity research financial institutions Malaysia, expects equity markets to remain tough and trading volumes on the local bourse to be fairly sluggish.

“Hopefully, the bond market may see a pick up in activity, especially from the government to finance their deficits but, overall, we expect it to be a tough year,” he says.

Some RM140bil of funds to be raised through private debt securities have been approved for this year but most contend the amount that will actually be raised may be lower due to waning capital market activities.

Chua says banks like Bumiputra-Commerce Holdings Bhd (BCHB) and AMMB Holdings Bhd may feel the heat this year as investment banking business is a significant contributor to group income, adding that AMMB’s exposure is about the same as other banks at 10% of total income, while BCHB’s is close to 20%.

“The good, the banks and the ugly”

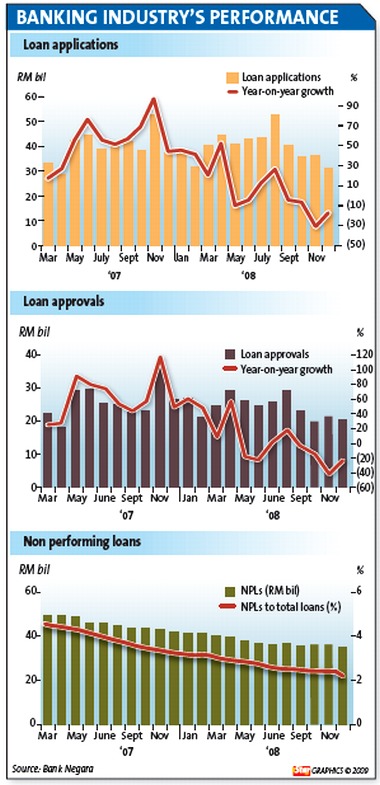

For commercial and retail banks, the major threat lies in the potential deterioration in asset quality or the proportion of bad loans or non-performing loans (NPLs) in the overall loan book. Simply put, in an environment of slowing economic activity and waning demand, there is usually the worry that businesses and individuals may face difficulties repaying loans, which could result in a rise in problem loans.

Although banks will continue to lend at the central bank’s behest, many expect the rate of loans growth this year to slow to mid-single digits from 10.7% year-on-year growth in November last year. This despite the higher-than-expected cut in the overnight policy rate by 75 basis points to 2.5% and reduction in the statutory reserve requirement (SRR) to 2% by Bank Negara a week ago to stimulate the economy.

The move by the central bank was prompted by the deteriorating economic conditions and outlook both globally and locally, in addition to the decelerating inflation rate. The latest cut brings the cumulative rate cut to 100 basis points since November last year. Bank Negara’s rate cuts by is part of a worldwide rate-cut spree undertaken by central banks to shore up their faltering economies.

As it stands now, most of the benchmarks remain intact – banks have beefed up risk management processes; the sector has a low loan-deposit ratio which means it’s safe and there’s ample liquidity; banks are well capitalised - risk-weighted capital ratio (RWCR) and core capital ratio as at Dec 2008 stood at 12.6% and 10.5% respectively; and asset quality is holding up well (as at Dec 2008, net NPL ratio improved to 2.2%). Nonetheless, no one dares rule out the adverse impact a protracted world economic recession, rising unemployment and retrenchments will have on the banking sector, which is the pillar of the country’s economic resilience.

Analysts say that since the consumer and manufacturing sectors are already hit, there may be a rise in bad loans in these segments. Consumer loans make up some 48% of the overall loans in the sector, with mortgages accounting for 27% of the consumer loan pie. The manufacturing sector accounts for 11% of total loans.

In anticipation of rising bad loans, it is learnt that banks are seeking the expertise of lawyers to train their staff on recovery and liquidation procedures on the back of a rise in letters of demand due to defaults on loan repayment.

On a positive note, Malaysian Rating Corp Bhd chief economist Nor Zahidi Alias does not expect the rise in NPLs to significantly affect banks’ earnings. “Banks’ provisioning is currently at a comfortable level where the loan-loss coverage (LLC) ratio has increase to 86.8% in November last year, compared with 77.3% in 2007.

“In fact, some banks have registered LLC ratio of over 100%, signalling the expected rise in NPLs will be well provided for, thus, preventing their bottom lines from being significantly affected.”

Lower rates, lower income

The latest cut in the OPR will have an impact on banks’ net earnings, particularly those with higher exposure to variable rate loans.

OSK Research expects net earnings at most banks to be negatively impacted by 7%-14% following the larger-than-expected OPR cut while ECM Libra Investment Research sees an impact of 5%-13% on net earnings (on the assumption the base lending rate will be reduced by similar quantum as with the OPR cut while deposit rates are lowered by an average 35-40 basis points).

Typically, banks’ margins will be affected by the OPR cut as lending rates will be re-priced downwards by a larger quantum than deposit rates.

According to OSK Research, banks with the largest proportion of fixed rate loans namely AMMB, EON Capital and Public Bank will be less affected than those with a large proportion of variable rate loans such as RHB Capital, Hong Leong Bank and Maybank.

Strengthening position

No doubt, banks are taking pro-active measures to ride out the financial storm. (read more in sidebar)

Many banks have moved to shore up their balance sheets to raise their resilience.

The country’s largest bank Malayan Banking Bhd is mulling over a RM3bil rights issue to raise its Tier-1 capital ratio after making RM11bil worth of acquisitions last year.

A month ago, Malaysia’s second largest lender CIMB Bank raised RM1bil of Tier-1 capital via a private placement. The proceeds from the programme will be used for CIMB Bank’s working capital and general banking purposes.

AMMB Holdings is proposing a special issue of 96.3 million new shares (3.4% of its existing paid-up capital) to bumiputra investors to enable it to reinstate bumiputra equity, a condition set by the Securities Commission following its approval in April 2007 for equity participation by Australia and New Zealand Banking Group Ltd (ANZ) in AMMB. The move, says an analyst, will be positive as it will also shore up the bank’s capital base, a necessity to withstand turbulent times.

They join scores of banks across Asia which have moved to beef up their balance sheets as they expect a tough operating environment ahead amid a global economic slowdown.

No doubt, the financial services and capital market will be hit this year by the raging global economic storm. Will the measures put in place by the Government, regulators and industry players be adequate to combat the crisis which has sent global markets in a tailspin, which in turn has led to battered market confidence?

Market watchers reckon that the current crisis will leave an indelible mark on the world’s financial landscape and lead to some dramatic reforms. The call for tighter worldwide regulation of the financial industry is almost deafening. To what extent such changes, if they at all materialise, would impact the financial architecture in Malaysia however, is a point worth pondering on.

Meanwhile, many are likely to continue to keep close tabs on the stream of data emanating from the country’s banking industry as a reflection of the country’s resilience, or lack thereof. |