PETALING JAYA: India’s decision not to impose import duty on crude palm oil (CPO) while maintaining a 20% duty on soybean oil is expected to boost CPO exports to the continent, at least in the first quarter of this year.

Despite mounting pressure by domestic oil producers’ associations to re-impose import duties on all edible oils, analysts said the Indian government was reluctant to impose duty on CPO – the world’s cheapest edible oil – ahead of the country’s general election, as it would be more expensive for local consumers.

AmResearch analyst Gan Huey Ling said the latest development in India was positive as “the tax differential between CPO and soybean oil enhances the attractiveness of CPO, which is now trading at a price significantly below soybean oil”.

Based on Malaysian Palm Oil Board statistics, the international price discount between CPO and soybean oil was US$235 per tonne last December against US$336 per tonne in the previous month.

“We believe that the absence of an import duty on palm oil would smooth out the flow of Malaysian palm oil exports to India, instead of just short-term demand spikes ahead of possible import duties,” Gan said.

Earlier, there was talk that the CPO import duty would be imposed before India’s election in May. It is believed that the Indian government was reluctant to impose the duty which could lead to an increase in the prices of key commodities although inflation had fallen below 6%.

In April 2008, India removed the duties on all vegetable oils to keep prices at bay, given its soaring inflation rate.

However, it imposed a 20% duty on soybean oil last November after the global prices of edible oils fell.

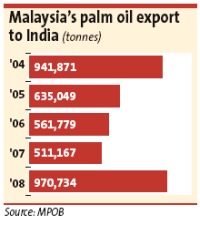

India used to be the largest importer of Malaysian palm oil before being replaced by China in 2002.

China overtook India as the biggest importer of Malaysian palm oil due to the growth of its economy, the abolishment of palm oil quota system and the fact that it imports palm oil mainly in refined form.

India imports its CPO mainly from Indonesia while from Malaysia, it imports mostly refined, bleached and deodorised (RBD) palm olein. India imports about 65,000 tonnes of palm oil from Malaysia every month.

ECM Libra Investment Research said in its latest report that the plantation industry was on a clear path to healthier times after a major oversupply situation.

Last month, local palm oil exports rose some 197%, driven by demand from India.

“We believe this is due to pre-stocking activities towards the implementation of import tax on palm oil. This could also be in reaction to the import tax imposed on soybean oil that was put into place in November,” ECM Libra said. |