|

PETALING JAYA: Research analysts are divided on whether investors should cash out on Permodalan Nasional Bhd's (PNB) offer to acquire property developer SP Setia Bhd's shares at RM3.90 per share and 91 sen per warrant.

Some analysts advised investors to accept the offer, which represents a premium of 11.4% for the ordinary shares and 97.8% for the warrants compared with the closing prices on Tuesday, while others said investors should adopt a “wait and see” attitude in view of the possibility of a higher offer price or counter-bid situation.

For several years PNB, together with its units, has been SP Setia's largest single shareholder with just under a 33% stake, the trigger point under the takeover code.

It passed the trigger point on Tuesday with additional market purchases.

Other major shareholders of SP Setia include the Employees Provident Fund with 13.4%, and SP Setia president and CEO Tan Sri Liew Kee Sin with 11.26%.

Analysts from ECM Libra Investment Research and OSK Research advised investors to accept the PNB offer.

ECM Libra Investment research head Bernard Ching said in a note that the offer was viewed as fair and attractive since it valued SP Setia at up-cycle valuations when the current market condition is on a downtrend.

“The offer price is also almost at parity to full intrinsic value based on our revised net asset value (RNAV) of RM3.98.”

Ching pointed out that the property sector might enter a cyclical downturn due to a weakening economic outlook, deteriorating housing affordability and policy risks.

OSK Research also opined that PNB's offer price was a decent exit strategy for investors.

“The offer of RM3.90 per share translates to 2.25x FY12 (financial year 2012) price-to-book-value which is slightly above SP Setia's five-year historical average price-to-book-value of 2.22x. The offer price also translates to 23.1x price-to-earnings ratio (PER) on FY12 earnings per share which was above the consensus FY12 PER of 18.04x as well as above SP Setia's five-year historical PER of 19.28x,” said OSK Research.

However, Hong Leong Investment Bank analyst Sean Lim said long-term investors who believe in the intrinsic value of SP Setia should not accept the offer.

“We agree with SP Setia's board that the offer price significantly undervalues the company as it is at 15% discount to our RNAV estimate of RM4.58, and appears unattractive versus the street's target price range of RM4.12 to RM5.41,” said Lim.

Lim added that there was a good chance of a better offer price materialising for SP Setia.

HwangDBS Vickers Research analyst Yee Mei Hui said PNB's offer was taking advantage of current weak market sentiments as it valued SP Setia at a 24% discount to RNAV of RM5.11.

“Also, the 11% premium over the last traded price offer is lower than 14% to 31% range seen for previous privatisation or mergers and acquisitions in the Malaysian property sector.”

A major concern was whether Liew and his management team would remain in the event of a successful takeover bid by PNB.

Kenanga Research said the company's fundamental value and branding would diminish considerably if SP Setia's current leadership and team exit.

“The key selling point of SP Setia has always been its management team and ability to turn around non-prime landbank into flourishing property development,” said Kenanga Research.

CIMB Research said the best-case scenario was for Liew to continue to run the company and PNB to go into joint ventures or inject property landbank into SP Setia at arm's length prices.

“This would give SP Setia access to PNB's vast landbank and open up other opportunities to the company.”

CIMB Research added that the worst-case scenario was Liew selling his entire stake.

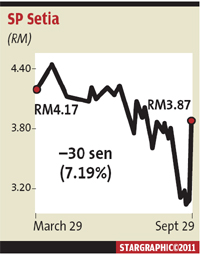

SP Setia's shares and warrants were among the top gainers and most actively traded yesterday.

Its share price closed 37 sen higher to RM3.87 while SP Setia-CC was up 6 sen to 7.5 sen, SP Setia-CD rose 5 sen to 7 sen and SP Setia-WB jumped 33 sen to 79 sen. |