|

PETALING JAYA: Both SapuraCrest Petroleum Bhd and Kencana Petroleum Bhd share prices closed higher yesterday amidst a sluggish market, signalling investors' favourable response to the proposed merger between the oil and gas (O&G) service providers to create the country's biggest player in the O&G realm in terms of asset value.

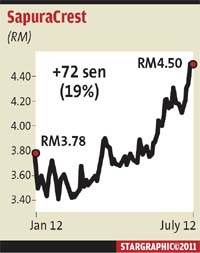

Kencana's share price shot up by 14 sen to RM2.94 with an intra-day high of RM2.95 while shares of SapuraCrest closed marginally higher at RM4.50, although it hit an intra-day high of RM4.57. The FTSE Bursa Malaysia KLCI (FBM KLCI) closed marginally higher as well at 1,578.10.

If the merger pulls through, the enlarged entity will have combined assets worth RM6bil. Analysts viewed the deal positively given the synergies that can be extracted from the exercise.

ECM Libra Investment Research said the O&G industry in Malaysia currently lacked a company which provides the full range of support services to take on major turnkey projects regionally and globally. “The business model that the merged entity will take on is similar to that of global companies like J.Ray McDermott, Saipem and Technip.

“The merged entity will also have the necessary skill set Kencana with its fabrication stronghold and SapuraCrest with its installation of pipelines and facilities business.

“Kencana builds the offshore structures that SapuraCrest is able to install, making both businesses complementary,” it said in a report yesterday.

The only area of duplication involves the offshore support vessel (OSV) business which both companies undertake as well as the hook-up and commissioning (HCM) services.

“We have known cases where both SapuraCrest and Kencana have wooed the same jobs. That said, OSV and HCM make up only a small part of both companies' businesses,” said the research house.

Both Kencana and SapuraCrest have received offer letters from special-purpose vehicle Integral Key Sdn Bhd (IKSB) to buy up the assets and liabilities of both companies, to be paid for in cash and new shares in the new merged entity.

IKSB's offer price is at RM5.87bil for SapuraCrest, which works out to RM4.60 per SapuraCrest share, and RM5.98bil for Kencana or RM3 per Kencana share.

For SapuraCrest, ECM Libra viewed the offer by IKSB, as fair as it approximated its peak cycle valuation of SapuraCrest at RM4.40. The merger consideration for Sapuracrest will be satisfied by way of 84.4% shares and 15.6% cash.

About 2.5 billion new shares in IKSB will be issued at RM2 each while the cash consideration amounts to RM875.1mil. On a per share basis, this translates into 68.5 sen cash and RM3.915 share swap per SapuraCrest share.

For Kencana, the purchase would be satisfied via the issuance of 2.51 billion new IKSB shares at RM2 each and cash of RM968.7mil.

OSK Research said Kencana would then distribute the IKSB shares and cash to its existing shareholders.

“The distribution of IKSB shares and cash shall take into consideration namely 1.84 billion existing Kencana shares, 149.3 million new Kencana shares to acquire underwater services company, Allied Marine & Equipment SB, as announced in May 2011, to be issued at RM2.68 per share share and 6 million new Kencana shares arising from the company's Esos.

The offer by IKSB via the asset and liabilities route, is open for acceptance by the board of directors of both companies up to Aug 15, subject to shareholders' approval at an EGM. |