|

PETALING JAYA: SapuraCrest Petroleum Bhd has confirmed that it is in talks with Australia-based Clough Ltd over a possible sale of the latter's loss-making marine construction business.

“SapuraCrest is currently in discussions with Clough regarding Clough's Marine Construction business. These discussions may result in a business acquisition, co-operation and/or other business arrangement with Clough,” SapuraCrest said in a filing with Bursa Malaysia yesterday.

It said the proposal was part of SapuraCrest's effort to constantly explore opportunities to grow its businesses in the oil and gas sector over the near to medium term.

“The proposal is expected to provide an opportunity for SapuraCrest to grow its regional presence, expand its activities in the subsea and deepwater segments as well as have access to a wider range of assets,” it said.

Clough, which is listed on the Australian Stock Exchange (ASX), is an integrated engineering, procurement and construction service provider primarily to oil and gas projects in Australia, South-East Asia and the SA.

In a separate statement to the ASX, Clough said while the parties continued to make good progress with their discussions, no binding arrangements had been entered into and there was no assurance that any transaction would ultimately be agreed or consummated.

Clough said it would provide further updates on the talks as appropriate.

According to some Australian news reports, Clough was understood to have hired advisers but refused to name any parties.

Analysts said it was still too premature to determine if SapuraCrest would be acquiring Clough's marine construction business.

However, they are keen on the prospect for SapuraCrest to form a cooperation with Clough's Marine Construction business or acquiring it.

An ECM Libra analyst said the move would be “positive” for SapuraCrest as it would provide a lot of synergy to the oil and gas group.

She said Clough's Marine Construction business was quite similar with a particular segment of SapuraCrest's installation of pipeline and facilities.

The analyst said although the unit was holding back Clough's profit last year, it had an orderbook of almost RM1bil. She added that the first-half results should show some improvements in its financial results.

“It will be a good time for SapuraCrest to move in at a time when Clough's unit is turning around,” she said.

Another bank-backed analyst said the move was seen as the way to broaden its earnings base and spur growth going forward.

“We see SapuraCrest's potential entrance into Clough's as highly positive because it will bring along expertise, new client base and branding,” he said.

“ We are positive on SapuraCrest's prospects as it currently controls some 70% of Malaysia's installation of pipelines and facilities segment.”

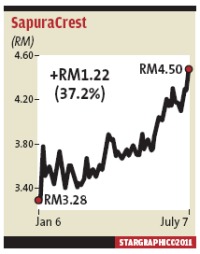

Meanwhile, SapuraCrest shares jumped when it resumed trading after it was suspended for an hour in early trade yesterday. Its shares touched an intra-day high of RM4.53, which is also its record high, before closing at RM4.50, up 16 sen, in active volume of 3.73 million shares. |