THE airline industry outlook for the first half of this year is relatively bleak due to depressed air travel markets borne from the natural disaster in Japan and political unrest in the Middle East and North Africa. As airlines try to maintain load factors and sustain yields, a big uncertainty that continues to plague the industry is oil price volatility.

Regional aviation analysts say rising fuel prices and increased competition from low-cost carriers (LCCs) and Middle Eastern airlines are risks that will continue to affect the performance of full-service carriers (FSCs) in this region.

They do, however, expect to see recovery in the second half of the year in both passenger and cargo markets. This will be supported by underlining economic growth trends, with LCCs such as AirAsia posting better performance over legacy carriers.

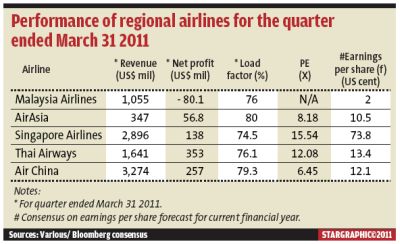

Both AirAsia and Malaysia Airlines (MAS) reported this week their first-quarter results for the period ended March 31, with both companies posting stark differences in their earnings.

AirAsia remained in the black, with its first-quarter net profit declining 23% to RM171.93mil from RM224.11mil posted in the same quarter last year, mainly due to lower unrealised foreign exchange gains.

However, the airline recorded a revenue growth of 21% to RM1.05bil compared with RM870.61mil a year ago due to a 17% increase in passenger volume and higher ancillary income per passenger. Operating profit for the first quarter was RM241.72mil against RM165.05mil a year ago.

AirAsia used a “load active” strategy to weather its first quarter, which saw its load factor for Malaysian operations risen to 80% from 74% a year ago while average fares declined by 5% to RM164.

Group chief executive officer Datuk Seri Tony Fernandes says the strategy behind this was to increase passenger loads and monetise that increase by growing the airline's ancillary income.

While analysts agree that AirAsia is the frontrunner in riding out the current volatility in fuel costs, its overall fuel bill will not be spared.

ECM Libra Investment Research reduced its financial year 2011 forecast earnings for AirAsia by 14% to RM869mil as the LCC's fuel assumption for this year has risen to US$120 per barrel compared with US$110 per barrel previously.

Maybank Investment Bank Research says in a report this week that the impact of AirAsia implementing its fuel surcharge in May will only be seen in late third quarter, as the bulk of the airline's second and third-quarter seats have already been sold without any fuel surcharge embedded in them.

The research house says it does not foresee the airline being able to achieve profit growth for the second and third quarters due to fuel price volatility and a possible overcapacity in Asia-Pacific.

Maybank IB says AirAsia is in a better shape than the industry it will take in eight aircraft this year and see some 8%-10% capacity growth.

“We don't think AirAsia's yields will suffer immensely as compared to the industry but the pace of yield growth momentum will definitely slow down. AirAsia's results last year is as good as it gets; the scope for incremental revenue is more challenging, going forward,” it adds.

AirAsia has hedged up to 17% of its fuel requirements until the second half of this year through a combination of jet kerosene and Brent fixed-swap contracts at US$124 per barrel and US$115 per barrel respectively.

However, MAS shocked many analysts with its poor first-quarter performance, recording a net loss of RM242.3mil compared with a net profit of RM310.05mil a year ago. MAS posted an operating loss of RM267.4mil due to higher fuel costs against an operating profit of RM289.5mil a year ago.

It is important to note that the operating profit made a year ago was mainly achieved due to a compensation that the airline received from Airbus in relation to delivery delays for its A380.

Analysts had expected MAS to gain traction on its turnaround, but were surprised by the extent of loss posted by the airline.

ECM Libra downgraded MAS from a “hold” to “sell' after the airline released its first-quarter results, as the research house does not expect the carrier to be profitable this financial year. It expects MAS to incur a full-year loss of RM914mil.

It is also very likely that MAS will post operating losses in the second quarter, which is traditionally the airline's weakest quarter in a given financial year. It made an operating loss of RM285.6mil for its second quarter ended June 30 last year.

ECM Libra adds that the airline's yield dropped 2.3% year-on-year to 22.7 sen/revenue per kilometre as revenue was affected by seasonality factor.

“Cost per available seat kilometre (ASK) escalated by 3.4% year-on-year to 26.6 sen/ASK due to increase in fuel costs, advertising, and non-aircraft depreciation expenses. Fuel cost now contributes to 38% of total operating expenditure,” it says.

Nomura Financial Advisory says that it would be too optimistic to expect any real impact from MAS' re-fleeting exercise this year and would likely see the benefits in another year.

“Although quarters three and four are likely to be seasonally better, we think given the sheer size of the first-quarter losses, a better second-half performance will not necessarily be able to buoy earnings performance for the full year,” it adds.

Meanwhile, regional peer Singapore Airlines (SIA) was not spared by higher fuel costs and posted a lower net profit of S$171mil for its fourth quarter ended March 31, against S$278mil made a year before. For the three-month period, the world's second-biggest airline by market capitalisation saw its quarterly revenue grow by S$3.59bil against S$3.34bil a year ago.

JP Morgan says in a report this month that SIA's management has adopted a cautious outlook, with the “twin challenges of near-term weakness in loads and high fuel prices adversely affecting the operating performance of airlines.”

In its report, Goldman Sachs says SIA's weak results were underpinned by softer-than-expected fourth-quarter passenger yields, which were flat quarter-on-quarter.

“Looking ahead, we continue to expect SIA's return-on-equity for the financial year ending March 31, 2012 to expand to 10.4% from FY11 level of 7.9%.

“This will be achieved on the back of less cash intensive capital structure, with lower net cash levels of S$4.9bil and continued passenger yield growth of 10% year-on-year for the current financial year, underpinned by strong load factor of 77%,” it adds. |