WITH the aviation industry on a cyclical upturn, it is no surprise that some major airlines have shown good financial results.

But what continues to separate the strong performers from the laggards is the ability to tap the right market segments while managing costs efficiently.

In this regard, Malaysian Airline System Bhd (MAS) seems to be lagging its regional peers.

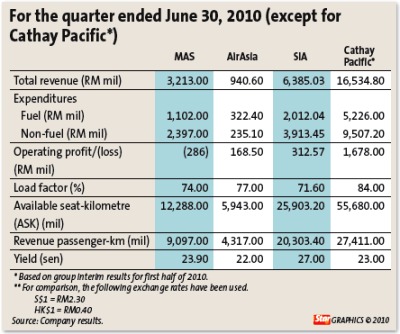

One indicator is growth, or lack of it, of MAS’ yield. Yield is defined as average revenue per km per paying passenger, which essentially calculates the revenue airlines get from passengers for every kilometer they travel.

For its second quarter ended June 30, MAS’ yield only grew by 2% compared with the same quarter in the previous year.

But Singapore Airlines (SIA) grew its yield by 15% for the same period. Hong Kong-listed Cathay Pacific grew its yield by 17% for the six months ended June 30 compared with a year ago.

Cathay Pacific and SIA have attributed their yield growth to strong demand from the business and premium passenger market.

“The yield growth serves as a leading indicator that MAS is not tapping into the right market segment,” says an analyst.

“The full-service carrier seems to be more focused on competing against AirAsia – a low-cost carrier, which is a completely different animal. It’s a wrong strategy for a full-service carrier like MAS to compete against another that operates on a completely different business model,” he explains.

Another analyst points out that corporate travel is picking up due to the global economic recovery.

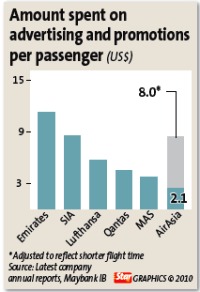

“We think MAS should invest more to create greater brand awareness in the international market... how else can you make yourself better known and become the preferred choice of air travel,” he says.

The analyst opines that the local carrier seems to be losing out in terms of brand awareness to other international airlines such as Emirates, SIA and Cathay Pacific.

MAS has slashed its advertising costs by 36.2% year-on-year (y-o-y) to RM37mil for the first half of this year.

The analyst questions this decision given that other airlines continue to invest heavily in advertising campaigns to stay on top of the competition.

“It’s not a coincidence why certain airlines are at the top in the world... they invest heavily in their brands,” says an analyst.

“There is huge potential for Asian airlines to tap... Some Asian brands are clearly rising as the preferred choice among the Western world, particularly since some Western airlines have been bogged down by the frequent cabin crew strikes,” he points out.

Besides aggressive marketing campaigns, aviation analysts also point out that regional airlines have beefed up their operational efficiency by using newer planes.

It’s been said that MAS’ ageing planes have been a financial burden to the company in terms of fuel efficiency and maintenance. Older planes tend to consume more fuel and require more maintenance.

MAS’ maintenance cost of RM446mil for the second quarter was an increase of 11.8% from the same period last year, and a staggering 42% quarter-on-quarter (q-o-q).

Fuel cost was also higher (44% y-o-y and 9.1% q-o-q) for the second quarter, due to oil price volatility, which had also hit other companies in the aviation industry.

To be fair, MAS is already addressing this issue by gradually phasing out its older planes. Analysts believe such effort will contribute even more to MAS’ improving operational efficiency.

However, MAS’ new planes will only come into operations in the next couple of years. The national carrier will take delivery of its first Airbus A380 plane only in April 2012 (MAS ordered six A380s in 2003, but deliveries had been delayed due to manufacturing problems.)

The second half is likely be a better period for MAS as demand for air travel accelerates. Analysts expect MAS to resolve its low yield growth, which is what management has committed to do.

The recovery in air travel demand is expected to continue benefiting low-cost carrier AirAsia Bhd. At present, forward bookings for August have already reached 54%, while that of September and October have hit 37% and 24%, respectively.

ECM Libra points out in a report that the recovery in air travel demand has increased AirAsia’s earnings visibility.

Many analysts regard AirAsia as the primary beneficiary of the rebound in air travel by virtue of its business model that can afford to offer competitively lower fares to the mass market.

The low-cost carrier also has the advantage because of the diverse routes it serves. The company saw its core operating profit for the quarter ended June 30 jump 31% y-o-y to RM168.5mil, while total revenue rose 26% y-o-y to RM940.6mil on strong growth in passenger volume, ancillary income and higher average fares. The company is expected to continue to outperform in the second half of the year. |