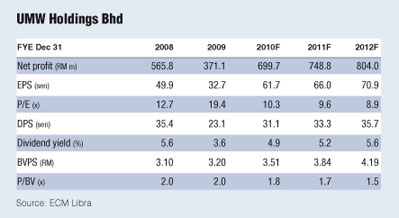

UMW Holdings Bhd (July 16, RM6.34)

Maintain buy at RM6.34 with target price RM6.95: UMW Toyota plans to locally assemble Camry models by mid-2012 as part of its RM170 million assembly plant upgrade programme. Over the next three years the paint shop, welding and automation departments will be upgraded. Doing so will reportedly increase annual production volume from 67,000 to 70,000. In 1HCY2010, UMW sold 44,000 Toyota cars (+19% year-on-year), of which 6,000 units were Camrys.

A large segment of the RM170 million to be spent will be used to improve the overall quality of vehicles. Currently, the assembly plant produces five major models — Vios, Innova, Hilux, Fortuner and Hiace. In addition to the assembly plant expansion, UMW plans to increase local content in its Toyota models from 40% to 50%.

We are positive on the news, as we understand from management that the assembly plant upgrade will offer the company the opportunity to tap into the export markets in the medium term. Upgrading the assembly plant will help boost the overall quality of its models, in particular the Vios, which we understand UMW has identified as among the Toyota models for exports.

The other model is the Camry, most likely once UMW has enough production capacity to cater for the domestic market probably within three to five years.

We believe Toyota will likely assemble the next generation Camry instead of the current fourth generation Camry which is already about four years old and is approaching its five-year replacement cycle.

By assembling the Camry models locally, UMW will likely benefit from higher margins by keeping the value of assembly within the company, while keeping pricing largely unchanged if UMW justifies the quality of the locally assembled models as comparable to the completely built-up (CBU) models. Currently, all Camry models are CBUs brought in from Thailand. By assembling the Camry models locally, UMW will likely benefit from higher margins by keeping the value of assembly within the company, while keeping pricing largely unchanged if UMW justifies the quality of the locally assembled models as comparable to the completely built-up (CBU) models. Currently, all Camry models are CBUs brought in from Thailand.

As the export plans have a medium-term horizon beyond our earnings forecast period, we are leaving our earnings estimates unchanged for now. While UMW remains a buy on the back of improving vehicle sales, its earnings may be bogged down by its underperforming oil and gas (O&G) division due to potential further delays in securing charter awards for its jack-up drilling rigs NAGA 2 and NAGA 3.

Given the current oversupply of jack-up drilling rigs and languidly recovering contract news flow, we believe UMW’s O&G profitability may be somewhat dampened by the inability to secure favourable charter rates for NAGA 2 and NAGA 3. Our sum-of-parts target price of RM6.95 remains unchanged. |