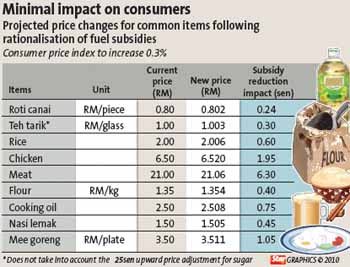

KUALA LUMPUR: The rollback in subsidies is not expected to cause a major spike in inflation and the impact on overall consumption will be minimal but the Government should ensure that profiteering does not become rampant, according to analysts and economists.

More importantly, they said the Government should enforce stringent measures so that food prices were kept in check to protect the interest of the lower and middle-income earners.

CIMB Investment Bank Bhd economic research head Lee Heng Guie said the five sen or 2.8% rise in the price of RON95 would have a minimal impact on inflation.

“RON 95 has a 6.5% weightage to the overall consumer price index - and the 2.8% increase translates to a 0.2% overall impact to the index, so that’s minimal,” he said.

He said the increase in prices of petrol and other goods was a “good first small step” towards the Government’s subsidy rationalisation plan.

He expected Bank Negara to maintain the overnight policy rate - the benchmark lending rate – at 2.75% for the rest of the year.

AmResearch Sdn Bhd senior economist Manokaran Mottain said the increase in prices was expected and minimal.

“Consumers should not be complaining. The important thing now is for the Government to enforce stringent measures to ensure that food prices are kept in check,” he said.

MIMB Investment Bank research head Chan Ken Yew said the rise in prices appeared manageable although it meant that inflation would be creeping up.

He was targeting an inflation year-on-year growth rate of 3.1% this year.

“We need to see what sort of remedial acts the Government would implement during the Budget. For example, will it reduce income tax? Will there be other relief measures?” he said.

ECM Libra research head Bernard Ching said the current price increases were acceptable and would not result in much inflationary pressures.

“Five sen for RON 95 is manageable. Now that sugar price has been increased, we may also see some supply coming back, as there were initially some hoarding activities.” he said.

Ching added that the Government was mindful of consumer sentiment and the impact of subsidy rollbacks on the man on the street. He said the Government would most likely compensate consumers by announcing some form of relief measures soon. |