YTL Power International Bhd (June 24, RM2.24) Maintain buy at RM2.25 with a target price of RM2.36: Recall that YTLP recorded a 3QFY10 net profit of RM301.7 million (+21% quarter-on-quarter) which exceeded our expectations.

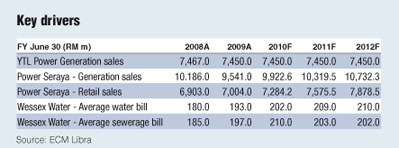

As expected, the company explained that this was due to Power Seraya, which saw its Ebit contribution surge 89% q-o-q to RM242.8 million in view of a recovering Singaporean economy, new unit demand from Resorts World at Sentosa and improved fuel cost management. This earnings momentum will likely continue in 4QFY10.

According to our analysis, Peninsular Malaysia’s reserve margin will plunge to nil in 2017 if there are no new plants up and the power purchase agreements (PPAs) of the first generation IPPs (YTL Power Generation is a first generation IPP) are not renewed. Assuming its PPA is renewed for another five years at similar terms, it will lift our discounted cash flow (DCF) per share valuation by 17 sen.

We opine that of all the listed IPP-based companies in Malaysia, YTLP has the widest skill set.

YTL Power Generation is gas-fired and PPA-based, 35%-owned PT Jawa Power is coal-fired and PPA-based as well, and Power Seraya is a multi-fuel-fired and power pooling-based. Thus, we believe it is well poised to bid for the 2,000MW of coal IPPs to be called for tender soon and IPP opportunities in Bangladesh.

Although RM2.5 billion or 30 sen per share over five years has been allocated for its WiMAX roll-out by year-end, we understand that vendor financing will allow YTLP to match capital expenditure with subscriber growth.

Hence, cash outflows from capital expenditure will be partially offset by cash inflows from subscriber growth. The company does not expect its free cash flow generation and dividends to be overtly affected.

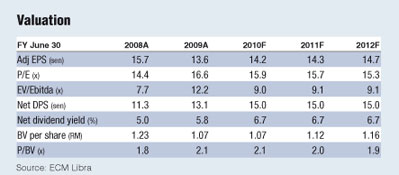

We raise our FY10 estimates by 19% to account for higher contributions from Power Seraya, but trim FY11 and FY12 estimates by 10% and 15% respectively for a weaker pound-ringgit exchange rate of RM4.80 (RM5.50 previously). In line with the weaker pound, we reduce our end-FY11 DCF-based target price from RM2.50 to RM2.36. We expect YTLP to pay 18.8 sen net DPS from now until end-

FY11. Investors can expect 13% upside potential. Again, our DCF-based target price will be raised by 17 sen should YTLP’s PPA be extended. — ECM Libra Investment Research |