Analysts are generally positive on Boustead Holdings Bhd’s plans to get into the healthcare business, but some are also questioning if it makes sense for the group to be so diversified. The conglomerate announced last Friday plans to take over Pharmaniaga Bhd, the country’s largest integrated pharmaceutical firm, a move that would see it having a seventh business division.

Boustead is already involved in plantation, property, heavy industries, finance and investment, trading and manufacturing and services.

“The good thing is that it’s buying a stable, revenue-generating business and it will be value-accretive. But its being too diversified is not really that good,” an analyst from a local research  house told Business Times. house told Business Times.

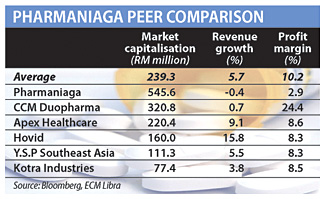

What is attractive about Pharmaniaga is that it is the sole government concessionaire for the supply of pharmaceuticals to government hospitals, which ensures steady earnings. Pharmaniaga gets about 55 per cent of its revenue from this concession business, while the rest comes from the manufacture and treading of medical products. Its profit margins, however are low when compared with its peers’.

In general, Pharmaniaga’s profit margin is about 2.9 per cent compared with its peers’ average of about 10 per cent. Rival CCM Duopharma, for instance, has a profit margin of about 24 per cent.

As such, some analysts argued that Boustead could extract higher returns if it invested in an existing core business like plantation, which it already knows well, instead of getting into something new.

“Ideally, l’d like them to be focused on the core earning-generating sectors like heavy industries and plantation,” one remarked.

Still, analysts acknowledged that, if managed well, the business held long-term potential, especially if Boustead made good on the ambition to expand Pharmaniaga’s business in Indonesia and Vietnam.

Pharmaniaga has sufficiently strong cash flows to fund its overseas expansion, with RM63.7 million in cash balances as at the end of the first quarter this year, ECM Libra Investment Research noted.

At least three research houses, including ECM Libra, maintained their “buy” call on Boustead yesterday. ECM Libra also raised its target price to RM4.48 from RM4.14.

Pharmaniaga’s share price surged on the stock market yesterday on the takeover news. It was the day’s biggest gainer, adding 7.7 per cent to RM5.49, its highest close since November 2005.

Boustead moved up 2.8 per cent to close at an intra-day high of RM3.68.

Boustead is forking out RM534 million in cash, or RM5.75 a share, to take up UEM Group Bhd’s entire 86.8 per cent stake in Pharmaniaga. It later plans to make a mandatory general offer for the rest of the shares, but ultimately wants to keep Pharmanaiaga listed.

The offer is a bit on the high end. It works out to a price-earnings multiple of about 10.8 times but the purchase will improve earnings, an analyst said.

Boustead expects its earnings per share to be enhanced by 5 sen next year as a result of the takeover. |