Reiterate buy at RM1.54, with target price of RM2: Sunway announced on Wednesday the acquisition of 33.37 acres (13.35ha) of leasehold land in Taman Equine, Selangor from Equine Capital for RM37.8 million or RM26 per sq ft which will be paid progressively over the development period.

The land is located close to the mature townships of Puchong, Bandar Sunway and Petaling Jaya, and easily accessible via Lebuhraya Damansara-Puchong (LDP) and Maju Expressway (MEX).

Other notable amenities nearby include a premier international school, Alice Smith, Universiti Putra Malaysia and various hypermarkets including Giant and Tesco. The land acquisition is conditional upon, among others, the procurement of development order and building plan as well as conversion of land use from agricultural to residential.

Sunway has high-end residential project of RM250 million in gross development value (GDV) in the works comprising semi-detached houses and bungalows. Indicative pricing is around RM1.2 million to RM2 million per unit. The project is targeted to be launched by first quarter of financial year ending Dec 31, 2011 (1QFY11) and will be developed over three financial years (FY11 to FY13).

Assuming a pre-tax margin of 20%, this project will contribute RM37.5 million net earnings over the development period.

There’s improving earnings visibility. This is the third land secured year to date which has added 148.7 acres and GDV of RM870 to the existing landbank.

The remaining GDV now stands at RM3.4 billion and the management is expected to continue to add more landbank to capitalise on buoyant property market. Sunway’s earnings visibility from property projects have been enhanced and our earnings estimate for FY11 and FY12 have been upgraded by 1.9% and 15.6% respectively.

Sunway is our top buy for the construction sector. This is premised on strong earnings growth of 47.1% in FY10, undemanding forward price-to-earnings ratio (PER) valuation of 7.7 times, more landbank acquisition in the pipeline, and strength in securing overseas construction contracts, in particular in Abu Dhabi and India.

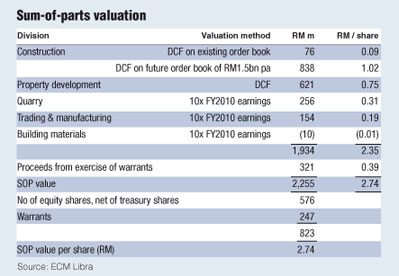

Although our target price is unchanged at RM2 which is derived from 10 times PE on FY10 earnings per share (EPS), sum-of-parts valuation has been upgraded from RM2.67 to RM2.74.

|