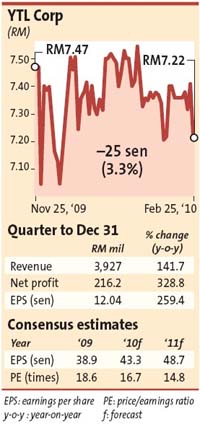

PETALING JAYA: YTL Corp Bhd recorded a 328.8% jump in net profit to RM216.2mil for the second quarter ended Dec 31, 2009 from RM50.4mil a year earlier due to better performance of its utilities and cement businesses.

Its pre-tax profit rose 80.8% to RM514.7mil for the second quarter versus RM284.7mil in the previous corresponding quarter.

ECM Libra analyst Bernard Ching said the results were above expectations due to lower-than-expected interest expense on borrowings taken mainly for its utilities division.

“The performance of all its divisions were pretty much in line with expectations,” he said.

Earnings per share (EPS) increased to 12.04 sen for the quarter under review compared with 3.35 sen in the previous corresponding quarter.

Revenue grew 141.7% year-on-year to RM3.9bil from RM1.6bil mainly due to the consolidation of the newly acquired PowerSeraya Ltd Group in Singapore by its power arm, YTL Power Bhd.

YTL Corp did not declare any dividend for the period.

For the six months ended Dec 31, 2009, the company recorded a 19.1% increase in pre-tax profit to RM1.02bil compared with RM854.4mil a year earlier while net profit rose 39.9% to RM423.7mil from RM302.8mil before.

Revenue grew 133.6% to RM7.8bil from RM3.4bil previously.

Its energy subsidiary, YTL Power, posted a second-quarter net profit of RM250.3mil, up 16.4% from RM215.1mil a year earlier mainly due to the consolidation of the financial results of PowerSeraya, which was acquired on March 6.

Turnover for the period jumped 265.9% to RM3.13bil compared with RM856.7mil before. Its EPS rose to 4.03 sen from 3.77 sen.

YTL Power proposed a dividend of 3.75 sen per share for the quarter.

For the six months ended Dec 31, 2009, YTL Power recorded a 21.7% increase in net profit to RM481.4mil compared with RM395.4mil a year earlier. Revenue grew 232.5% to RM6.3bil from RM1.9bil.

YTL Cement Bhd, meanwhile, posted a 16.6% rise in net profit to RM56.4mil for the second quarter versus RM48.4mil in the year-earlier period despite lower revenue due to improved operational efficiencies and lower production cost.

Revenue slipped 1.7% to RM483.6mil from RM491.9mil. Its EPS rose to 8.01 sen from 7.49 sen.

YTL Cement also proposed a dividend of 3.75 sen per share for the quarter.

For the six months ended Dec 31, 2009, YTL Cement recorded a 6.9% increase in net profit to RM125.7mil compared with RM117.6mil previously while revenue slipped 2.1% to RM931.2mil from RM950.9mil. |