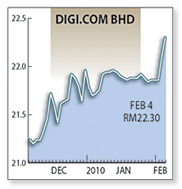

ECM LIBRA Investment Research has maintained its "hold" call on DiGi.Com Bhd with a revised target price of RM23.20 from RM20 previously, following the company's revenue growth guidance of at least 5 per cent for fiscal year 2010 (FY10).

"It is also based on the growing expectations that EBITDA (earnings before interest, taxes, depreciation and amortisation) margins have stabilised and may improve marginally next year on the back of further cost optimisation," the research house said.

The report issued yesterday said that the DiGi's full-year results for the fiscal year  ended December 31 2009 (FY09) announced on Wednesday were within expectations. ended December 31 2009 (FY09) announced on Wednesday were within expectations.

"Its full-year revenue rose 2 per cent as its subscriber base expanded, but net profit declined 12 per cent due to higher traffic costs from competition, bad debts and operating expenditure from expanding its broadband services," it said.

It expects DiGi to continue paying out 130 per cent of its earnings as dividends for FY10-12, given its strong cash flow and consistency in payout ratios of roughly 130 per cent in FY07 and FY08.

Meanwhile, ECM Libra has reduced its capital expenditure (capex) assumption from RM800 million-RM900 million per annum to RM700 million-RM800 million after DiGi reiterated that capex in FY10 will be around the FY09 level.

"This year DiGi is targeting to grow its mobile broadband business as its 3G rollout gains traction by expanding its 3G population coverage which stood at 30 per cent as at end 2009," it added. |