Genting Malaysia Bhd

(Jan 15, RM2.89)

Downgrade to hold, target price lowered to RM2.88: GENM is due to release its 4QFY09 results by late February. We understand that the core net profit will be comparable to that recorded in 3QFY09 (RM407.9 million) and 4QFY08 (RM393 million).

While the 4QFY08 results were driven by better luck factor in the lower margin VIP segment, the 4QFY09 results will be driven by the higher margin mass market segment.

We understand that 4QFY09 visitor arrivals to Resorts World at Genting (4QFY08: five million) were higher year-on-year due to the three “three-day weekends” in Dec 2009.

Despite potentially posting excellent 4QFY09 results, we believe its share price will hover around current levels due to cannibalisation fears from the two Singaporean integrated resorts (IRs) — Resorts World at Sentosa, owned by sister company Genting Singapore, and Marina Bay Sands owned by Las Vegas Sands.

Resorts World at Sentosa’s casino is expected to open by March while Marina Bay Sand’s is expected to open by April.

We believe the longer the two IRs delay the opening of their casinos the longer GENM’s share price will be capped. This is because more time has to pass before the two IRs open and announce their casino revenues and only then can their impact on GENM’s casino revenues (FY08: RM4.3 billion) be quantified.

We previously liked GENM for its huge net cash pile which we estimate will burgeon to some RM6 billion or RM1.01/share by end-2010. However, judging by the spate of investments that GENM made since the controversial acquisition of 10% shareholding in Walker Digital Gaming in Nov 2008, GENM has not executed any major M&As. We previously liked GENM for its huge net cash pile which we estimate will burgeon to some RM6 billion or RM1.01/share by end-2010. However, judging by the spate of investments that GENM made since the controversial acquisition of 10% shareholding in Walker Digital Gaming in Nov 2008, GENM has not executed any major M&As.

While the investments in MGM Mirage and Wynn Resorts debt securities may allow GENM to acquire their casino assets should they default in the future, the most recent acquisition of Wisma Genting and property in Segambut reflect a lack of attractive investment options available to the company.

An important thing to note is that the call option to acquire 10% of Walker Digital Lottery for US$27 million (RM90.4 million) expires in May 2010.

We understand that the company has not deliberated on whether to exercise it or not. Should it decide to do so despite the absence of a profit track record, GENM’s share price will be pressured to depreciate.

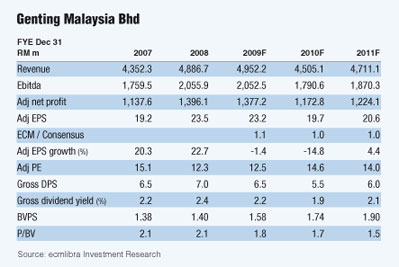

We trim our 2009-2011 earnings per share (EPS) estimates to account for lower interest income derived from a low interest rate environment. In addition, we also now assume 25% cannibalisation of GENM’s VIP gaming revenue, which comprised 33% of its 2008 gaming revenue. The net impact is to reduce our 2010 and 2011 EPS estimates by 13% per annum.

If we were to roll forward our discounted cash flow (DCF) valuation to end-2010, we would arrive at a DCF value of RM3.67/share. This would suggest 27% upside potential. That said, given the dearth of avenues for GENM to invest its huge net cash pile constructively, we no longer believe that it deserves to trade at DCF.

We now utilise a one-year forward price earnings (PE) of 14 times, the average one-year forward PE that GENM has been trading at ever since the first Singaporean IR was awarded to Las Vegas Sands in May 2006.

We do not believe that it should trade at the long-term average one-year forward PE of 15 times as it does not reflect the impending competition from the two Singaporean IRs.

Ascribing 14 times PE to our 2011F EPS of 20.6 sen, we arrive at a revised target price of RM2.88. Our PE valuation method implies that some 75% of GENM’s net cash pile has been discounted.

This discount is justified as long as it does not invest its net cash pile constructively or pay higher dividends. — ECM Libra Investment Research, Jan 15

This article appeared in The Edge Financial Daily, January 18, 2010.

|