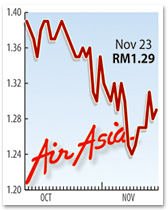

Analysts have cut their forecasts for AirAsia Bhd's (5099) profits for the current year after the low-cost carrier's third-quarter core operating profit fell short of their expectations.

|

Although the stock was upgraded to a "buy" call last week, OSK Research has now downgraded AirAsia's fair value to RM1.13 based on 10 times financial year 2010 (FY10) earnings per share (EPS) and reduced its recommendation to a "sell".

"As we believe the price undercutting (for air fares) and escalating crude oil price would persist in the short to medium term, we downgrade our projection by 31 per cent and 46.5 per cent for FY09 and FY10 respectively," it said in a report yesterday.

While AirAsia's net profit was RM130.1 million, its core operating profit was RM33.8 million after adjusting for foreign exchange gains.

Analysts were surprised by the further contraction in average fares to RM141.60, or lower by 11.5 quarter-on-quarter, although they projected a poorer third quarter as it is seasonally the airline's weakest quarter.

"The firm's fuel price averaging US$79.30 (RM268. 03) per barrel in third quarter was 30.4 per cent higher quarter-on-quarter, which was higher than the average 12.8 per cent increase in fuel cost over the same period," OSK said.

HwangDBS Vickers Research has cut its FY09 forecast core earnings by 12 per cent to RM378.7 million after factoring in a lower yield of 12.6 sen (from 13.3 sen) as well as higher jet fuel costs.

It maintains that the stock is fully valued, with the stock currently trading at 9.5 times FY10F EPS (ex-EI) and 1.1 times FY10F BV, higher than peers' 8.0 times and 0.9 times, respectively.

However, ECM Libra Investment Research is maintaining its "buy" call on the stock as it views the current quarter's results as just a blip.

"Most full service carriers are expected to post losses in the third quarter on aggressive fare cutting and this cannot go on indefinitely, especially when fuel cost is rising again. As economic recovery gains traction, we expect airfares to normalise," it said in a report.

|