KUALA LUMPUR: Putting an end to weeks of market rumours, PUBLIC BANK BHD [ registerQuotes("PBBANK", "PBBANK_span"); ] said yesterday its non-executive chairman Tan Sri Dr Teh Hong Piow has recovered from a minor operation and will not be selling his stake in the bank.

Calling the rumours “totally unfounded and absolutely without basis”, the bank said in a statement that the group’s founder was presently in “very good health” after having “fully recovered from a minor operation which he had undergone recently”.

Teh, 78, has been with the conservative banking group for the past four decades, having established it when he was only 35.

“Tan Sri Teh, the founding and single largest shareholder who owns total interests of 24.08% in Public Bank, has stressed that he has absolutely no intention of selling his stake in Public Bank,” the statement to Bursa Malaysia said yesterday.

It said Teh “remains fully committed to Public Bank which he founded and has so passionately built to its present stature over the past 43 years”.

This overdue statement will perhaps finally and effectively put an end to rumours that have been circulating that Teh’s exit from Public Bank was imminent following news that he had been admitted to hospital for an operation in July.

According to The Edge weekly’s latest edition, adding fuel to the fire was talk that Hong Leong Group’s Tan Sri Quek Leng Chan and CIMB Group CEO Datuk Seri Nazir Razak were eyeing Public Bank, which is one of the country’s most profitable banks.

Teh, 78, is not selling his stake in Public Bank as he ‘remains fully committed’ to the lender he founded 43 years ago. Teh, 78, is not selling his stake in Public Bank as he ‘remains fully committed’ to the lender he founded 43 years ago.

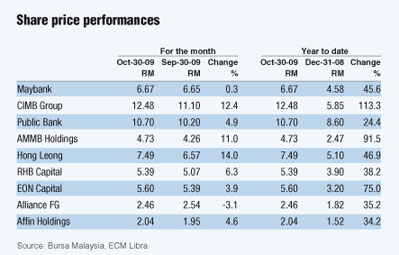

Speculation of a Public Bank takeover and the re-rating of banking stocks have caused the share prices of CIMB and Hong Leong to rise over the past few weeks.

This is combined with the fact that both banks are doing reasonably well, especially with regard to their overseas operations and in the case of Hong Leong, a possible sale of its

insurance arm to Japan’s Mitsui Sumitomo Insurance Co.

Public Bank’s share price has also gained following a recovery in market sentiment. Yesterday, the stock closed at RM10.68, up 20% from RM8.60 on Dec 31, 2008. It fell two sen yesterday after trading between RM10.62 and RM10.70, with a total of 1.11 million shares done.

Notwithstanding the rumours about Teh’s exit, a high valuation for the banking group may be the predominant obstacle to it being acquired, at least by the other local players.

According to The Edge weekly, Public Bank will not be cheap, while the other main banking players, including Maybank, CIMB and Hong Leong, are still preoccupied with implementing their regional expansion plans. Furthermore, the weekly had learnt that Teh was adamant about not cashing out.

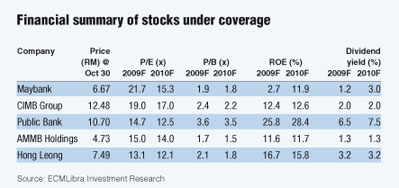

Meanwhile, ECM Libra Research said yesterday Public Bank remained a top pick given its attractive growth prospects. Its relatively cheap price-earnings ratio (PER) of 14.7 times for the 2009 financial year forecast compared with a mean PER of 16.7 times for the sector adds to its appeal.

|

|

ECM Libra has a trading buy call on the bank with a target price of RM12.80 based on 15 times earnings per share (EPS) on CY10 forecast.

“Public Bank has proven its ability to grow while not sacrificing its asset quality,” it said in a research note on the banking sector yesterday. “It has superior return on equity (ROE) and asset quality.” It maintains its neutral call on the banking sector as a whole in its October monthly review.

ECM Libra said, overall, the banking system’s capitalisation remained stable and October was a fairly good month in terms of performance for most banking stocks, with key players like CIMB, AMMB Holdings and Hong Leong Bank seeing double-digit growth.

According to the report, loans growth in September continued its on-year weakening with an expansion of 7.2% compared with 7.3% the previous month.

The research house added that this was in line with its expectations of average loans growth of 5% to 6% for 2009 given the still-fledgling economic environment and led by weakening in the business loan sector. However, it expects this figure to rise to 7% to 8% going forward. |