At current prices, S P Setia Bhd shares offer accumulation opportunities for capital gains in anticipation that the stock will be re-rated upwards against the backdrop of more positive updates from the property developer.

In a note, Kenanga Research said S P Setia shares could benefit from the implementation and progress of the company’s overseas and local real estate initiatives.

“The current price weakness provides investors with good accumulation opportunities, especially when we expect share price to re-rate upwards in the near future from more positive news flow (such as finalisation of the China project, more Vietnam projects and improved sales, commencement of Abdullah Hukum project),” said Kenanga  which reiterated its trading buy call at RM3.81 with an unchanged target price of RM4.25. which reiterated its trading buy call at RM3.81 with an unchanged target price of RM4.25.

Kenanga whose note was issued following the announcement of S P Setia’s latest US$250 milion (RM850 million) mixed development in Vietnam, said the finalisation of the job on 10.7ha in Lai Thieu Town, Thuan An District, Binh Duong province, would add at least 14 sen to the research house’s fair value for S P Setia shares.

The project, to be completed within six years, is expected to comprise some 1,700 units consisting of shop, terrace and semi-detached houses, apartments, besides commercial centres and a club house.

RHB Research said it liked S P Setia’s latest Vietnam project because the land cost would be paid progressively over the next three years and part of the payment would be financed by the project.

By virtue of the project’s proximity to the Vietnam Singapore Industrial Park and Ho Chi Minh City, RHB said S P Setia’s real estate initiative would appeal to a range of market segments including young couples with growing families and businessmen.

RHB upgraded its recommendation for S P Setia shares to outperform from market perform with an unchanged fair value of RM4.64.

ECM Libra Investment Bank, however, said S P Setia shares were overvalued, prompting the research firm to maintain its sell call for the stock with a target price of RM3.36.

“We believe S P Setia’s strong sales momentum YTD (year to date) has already been priced in and as such, maintain our sell call,” ECM Libra wrote.

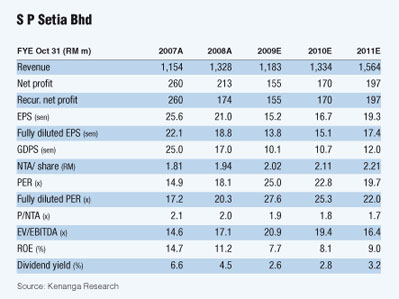

Kenanga, RHB, and ECM Libra have maintained their estimates for S P Setia’s financials, following the announcement of the developer’s latest Vietnam project.

Yesterday, S P Setia closed flat at RM3.81.

|