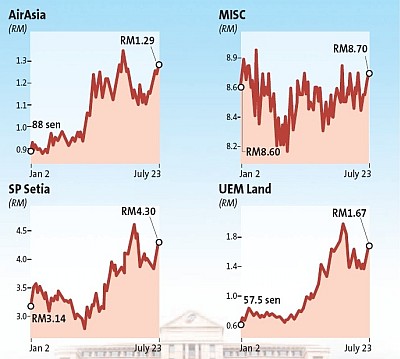

IN good or bad times, there is always value to be found. StarBizWeek polled several analysts’ views on their stock picks and have compiled a list of eight stocks from several key sectors.

AirAsia Bhd

On the back of a 23% passenger growth and 77% load factor, analysts are expecting AirAsia Bhd’s quarterly results next month to surprise on the upside.

“Ancillary income will offset fuel price increase. It acts as the best defence against fuel price increase as every RM1 per pax increase will offset US$1 per barrel increase in fuel price,” says an analyst from ECM Libra.

He adds that ancillary income has doubled to RM29 per pax within the last two years and management targets to double it again to RM60 per pax by introducing more value-added services.

Meanwhile, AirAsia plans to defer the delivery of 15 A320 aircraft as it expects the construction of the new LCCT to be further delayed. Hence, capital requirement will be reduced by RM2.3bil while gearing will also be lowered.

“We reiterate our buy call on AirAsia with a target price of RM1.90. AirAsia is poised to outperform on consensus earnings upgrade in anticipation of strong second quarter results, sustained low fuel price and potential dual listing (or merger),” he says.

The analyst forecasts an 8.89% increase in revenue to RM2.87bil while net profit is expected to jump 211.13% to RM598.3mil for its year ending Dec 31, 2009. |