This is attributable to improving power demand and stronger economy

PETALING JAYA: Tenaga Nasional Bhd (TNB) is likely to post stronger earnings in the fourth quarter ending Aug 31, given the improving electricity demand and stronger economic activities, according to analysts.

HwangDBS Vickers Research said TNB’s earnings in the third quarter to May 31 were supported by demand recovery and lower coal cost.

However, the earnings were partially dragged down by the 7% quarter-on-quarter increase in generation cost as coal price averaged US$94.30 per tonne and coal usage rose due to gas curtailment.

The brokerage said TNB’s 9-month power demand weakened 3.7% but there had been positive month-on-month growth since March, driven by the cement and concrete sector.

It expects demand to grow by 1.5% in the financial year ending 2010 (FY10) following the implementation of pump-priming projects.

“But we expect stronger fourth-quarter earnings and upgrade FY09 forecast net profit by 11% after factoring in lower capital expenditure by RM500mil.

“TNB has cancelled some planned upgrades due to weaker power demand and reduced interest expense following its recent loan repayment,” HwangDBS said in a research note.

The brokerage said TNB would continue to benefit from stronger economic activities. It maintains a “buy” call with RM9 target price based on 17 times calendar year 2010 earnings per share.

Kenanga Research upgraded TNB to trading “buy” with a target price of RM9 from RM7 previously.

It tweaked the utility company’s FY09 to FY10 estimated net profit upwards by 10% to 11%, to between RM1.5bil and RM2.9bil, mainly due to improved foreign exchange (forex) rates.

It also adjusted the group’s unit demand growth rates, coal cost assumptions and inclusion of provisions reversals in the fourth quarter.

With TNB management hinting at the higher end of its 40% to 60% dividend payout of free cashflow for FY09, the brokerage was assuming a 55% payout.

Meanwhile, ECM Libra Investment Research has increased its demand growth assumption for FY10 to 3% and maintained its FY11 demand growth assumption at 4%.

However, it said TNB expected coal cost to average at US$90 per tonne for FY09, resulting in higher-than-expected operating expenses.

“The industrial sector, particularly the steel industry, should continue to register growth as steel players increase utilisation of their plant on higher demand for steel,” it said in a note.

OSK Research said: “With stronger demand in the fourth quarter, no more gas curtailment and the possibility of write-backs of provisions, we should see better core profit for the fourth quarter in FY09 although the weakening ringgit may result in forex losses.”

However, TA Securities downgraded TNB’s FY09 earnings estimate by 9.8% after adjusting for the higher-than-expected effective tax rate, lower-than-expected non-operating income and sharp decline in exports sale.

Subsequently, it also downgraded FY10 earnings forecast by 2.8%.

“We expect generation cost to continue rising in the fourth quarter as coal usage increases in tandem with the anticipated stronger demand.

“In addition, management has raised average coal cost per tonne estimate to between US$90 and US$95 per tonne in FY09 due to rising market price,” TA Securities said in a research note.

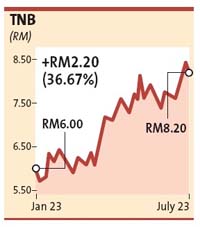

The brokerage reckoned demand recovery had been largely priced in, as the stock had gained 29% since it upgraded its “buy” call in April.

Moving forward, the market would be more concerned about generation cost creeping up before the next tariff review, due in January, it said.

|